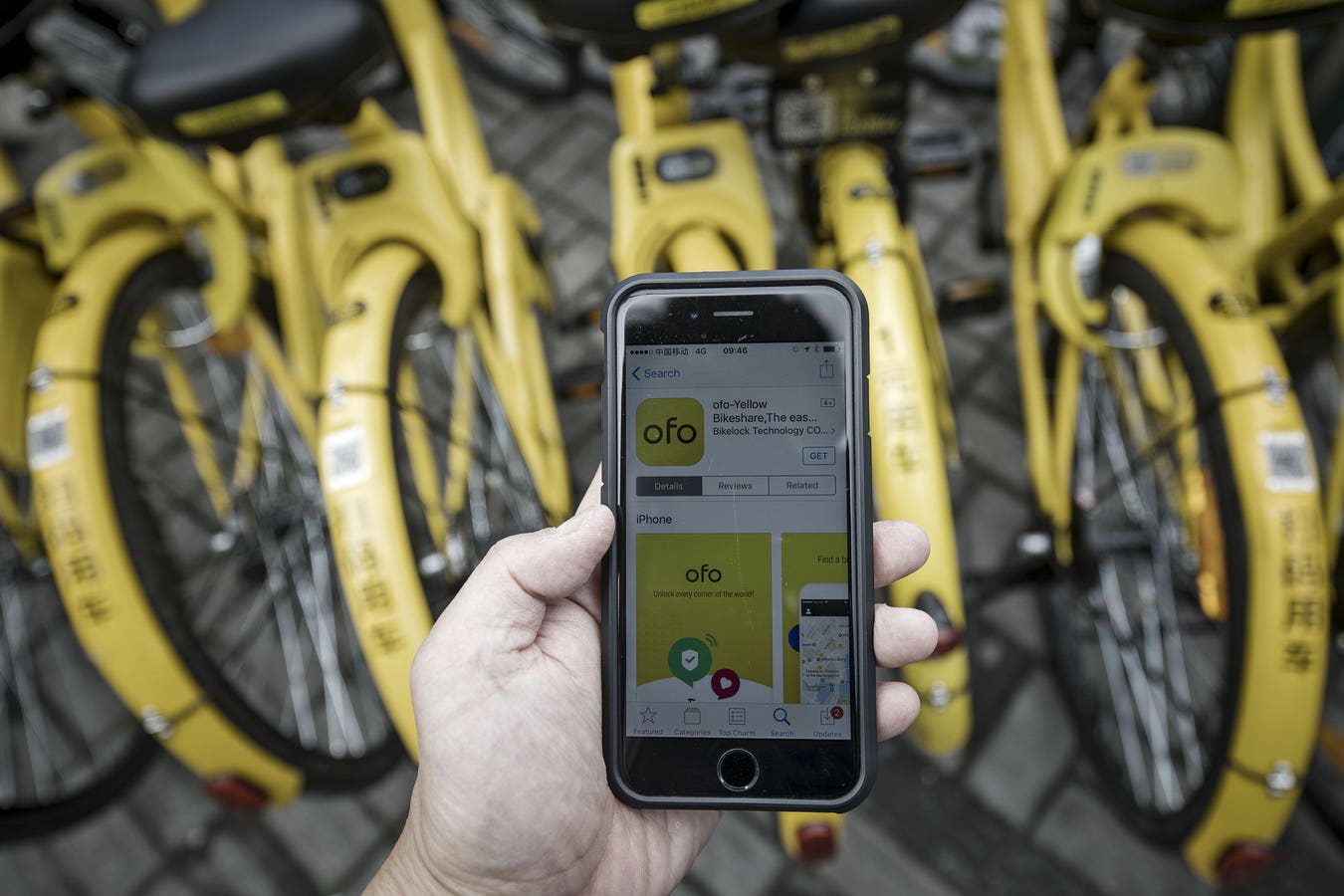

Over the past year, several Chinese startups have deployed tens of millions of colorful bikes in cities across the country, which can be cost-effectively rented on a smartphone. And this decreases among city dwellers who are fed up with congested and polluted streets.

Read more: Chinese bike-sharing apps emerge as the craze among startups and unicorns

The low load and flexibility attract tens of millions of trips every day, while others look for opportunities in China’s traffic-congested cities. And consumers come from all walks of life, from blue-collar workers to young tech professionals. “I use the motorcycle to go to the supermarkets because it’s a bit far to walk and it’s too long to wait for the bus,” said Jacky He, a 28-year-old marketing manager at a web startup. “I can locate a motorcycle when I need it and I don’t have to worry about parking.

Valuable data

While the potential duration of these ventures has undoubtedly helped attract millions of dollars’ worth of investments, the real selling point for these investors is having millions of tech-savvy users.

Companies such as Chinese e-commerce giant Alibaba, whose monetary subsidiary Ant Financial is an investor in Ofo, see an opportunity to offer other products and facilities such as payment apps. They also need access to valuable insights into user behavior and rental history, he says. Zhou Wei, founder of China Creation Ventures. Another use may be to get a broader idea of a person’s credit history.

Read more: China’s innovative smart bike startups face hurdles at home and abroad

Unlike the United States, China doesn’t have reliable credit scoring providers like Experian and Equifax. It’s up to web corporations to expand their own facilities, such as Ant Financial’s Sesame Credit, from unconventional knowledge resources, such as online food shopping behavior and social media behavior. .

“These motorcycles have wonderful strategic importance for Alibaba and Tencent,” Zhou said. “It’s a much-needed way to gain insights into ordinary users. “

Growth Potential

The projected expansion of operators like Ofo is equally attractive when so many sectors face such challenging market conditions.

“It’s very complicated for corporations with such explosive expansion today. The expansion is even faster than online ride-hailing and food delivery platforms in their early days,” said Helen Wong, an investor at Qiming Venture Partners, which backs Mobike.

According to iiMedia Research, a Guangdong-based consultancy, the bike-sharing market is expected to be worth 10. 3 billion yuan ($1. 5 billion) by the end of this year and 23. 7 billion yuan ($3. 5 billion) by 2019. As the market grows, corporations can seamlessly offer more than a hundred million rides every day, said Cheng Tian, an investor at Shunwei Capital, the venture capital firm co-founded by billionaire Xiaomi founder Lei Jun. Shunwei is an Ofo donor.

But everyone is convinced.

In a column published through Chinese consultancy iResearch, Wang Yijian, a prominent online commentator, questioned how such startups can simply build a sustainable business with 15-cent rides; Often, even free rides when businesses are looking to attract new customers. He noted that each motorcycle costs up to 3,000 yuan ($440) to make. Adding to the demanding situations are common cases of misuse and vandalism, meaning motorcycles don’t last more than six months and require an ever-expanding team to maintain and repair them, said Ken Xu, an associate at venture capital firm Gobi Partners.

In addition, bicycles are emerging as an urban problem. They’ve clogged sidewalks because they don’t require a designated docking station, prompting several city governments to consider new rules on parking and maintenance.

Shunwei’s Cheng said there was an oversupply of bicycles in some areas. Companies want to flood China’s busiest streets with bicycles to raise awareness of the logo and outshine their competitors, even though they know other people may not want them all.

Read more: Sharing is Caring: China’s Smartphone ‘Sharing Economy’ Is Booming

“If the festival is so fierce, companies can recover their production prices in a year at most,” he said. “Now we’ll have to wait another year or two for the war to calm down a bit. “