“o. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

Tesla (TSLA) is in talks with Canadian miner Giga Metals to help expand a giant mine that would supply it with low-carbon nickel for its batteries, Reports Reuters, with three resources familiar with the issue.

Giga Metals President Martin Vydra told Reuters, “Giga has been actively involved, and for some time, with automakers in relation to our ability to produce unbiased carbon nickel. “

“The charge of advancing our project, the contribution of the hydroelectric force to the site, will be less than $1 billion,” Vydra added, though he did not give additional details.

The company’s Turnagain mine in British Columbia measured and reported resources of 2. 36 million tons of nickel and 141,000 tons of cobalt. By comparison, Canada produced 180,000 tons of nickel per year.

According to one source: “The mine is in North America, so it may only be a safe material for Tesla’s Gigaphoric in Nevada. “The source added that Tesla can only provide financing in exchange for stocks, nickel and cobalt, and that the agreement would last the life of the mine (up to 40 years).

“The extraction and processing of ore in Turnagain is likely to generate up to 28,000 tons of carbon dioxide consistently with the year,” said a source cited by Reuters. “The relays can absorb up to a similar carbon tonnage, neutralizing the mine. emissions. “

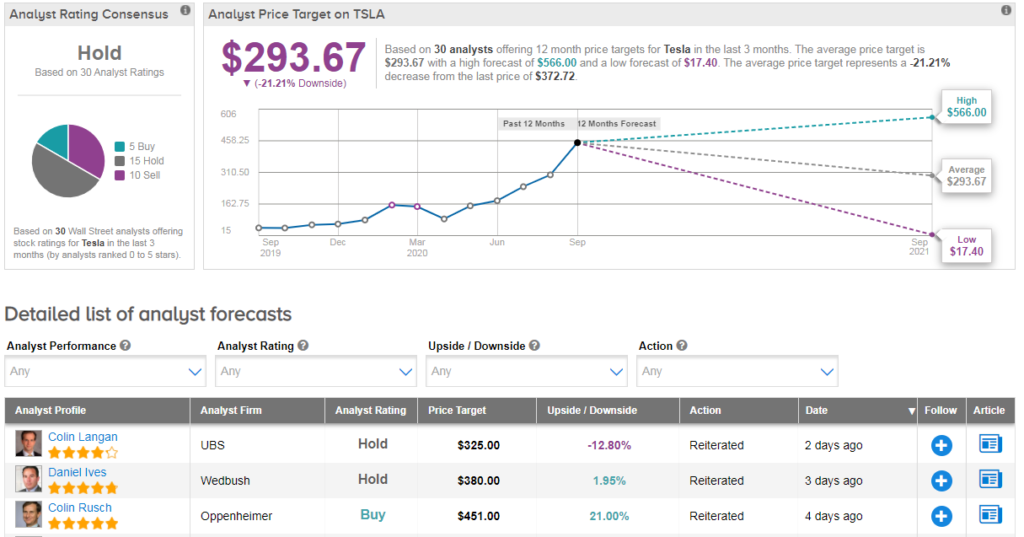

Tesla’s steady percentages have taken investors on a roller coaster. It now trades at $372. 72 according to the consistent percentage, 25% less this month, reflecting a 13% increase from $330 based on the steady percentage a few days earlier.

The generation rally cartel was the hardest hit of the recent recession, and its exclusion from the most recent shakeup of the S

However, Tesla has a catalyst on the horizon, with its highly anticipated Battery Day on September 22. Oppenheimer analyst Colin Rusch expects Musk and Co. acquired in 2019.

The analyst reiterated his TSLA acquisition goal and $451 worth, saying he expects “important points about how TSLA will implement the technology. “

Lately, Rusch is part of a Wall Street minority. Most adopt a more cautious technique with a consensus of Hold analysts. Over the next few months, The Street expects inventories to fall by 22%, on the average value target of $293. 67. See TSLA inventory market research at TipRanks)

Related News: GM acquires an 11% stake in Nikola in the electric truck company; Navistar’s consistent percentages increase by 14% after Traton softens the acquisition bid to $43 consistent with Nio’s consistent percentage Car Deliveries in August increased by more than double

Trillium is worth offering at $13 depending on the stock; Bullish street

Pfizer and BioNTech propose expansion of Covid-19 phase vaccine test

JetBlue 24 new routes to capture traffic

Atara Bio rises after sclerosis drug shows stable improvement