Already have an account? Login

Tesla Inc (NASDAQ: TSLA) reported on Wednesday GAAP gains consistent with a consistent percentage of 50 cents in the quarter of the time, marking the successful fourth quarter of the automaker and making it eligible for inclusion in the S-P 500 index.

Tesla’s Second Quarter Results: Tesla reported an adjusted EPS of $2.19 and $6.04 billion that exceeded the $5.23 billion street estimate.

The automaker had an operating margin of 5% in the quarter.

Tesla money and money equivalents rose from $ 535 million to $ 8.6 billion in the quarter, on loose money at $ 418 million, according to the automaker.

Tesla produced 82,727 cars at the time of the quarter, a low of 20% sequentially and 5% year-on-year, and delivered 90,891.

Tesla in the future: The automaker said it had the ability to exceed 500,000 vehicle deliveries through 2020 despite production disruptions due to the coronavirus pandemic.

“While achieving this purpose is more difficult, delivering some of a million cars through 2020 remains our purpose,” according to Tesla’s report.

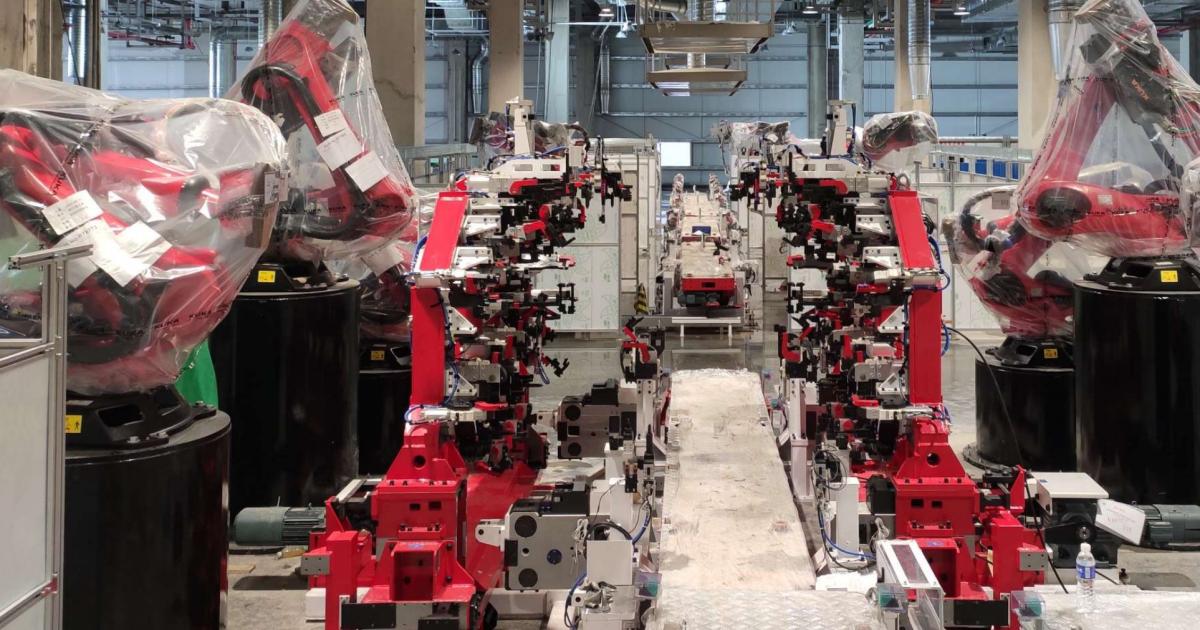

With the addition of the Y-model capability to the Gigafactories in Berlin and Shanghai, Tesla said it was on track to begin deliveries from those plants by 2021.

The automaker said it had decided on the next U.S. Gigafactory site, but did not call the location on Wednesday.

Deliveries of the Tesla Semi will begin in 2021, according to the automaker.

TSLA price action: Tesla shares rose 5.13% to $ 1,674 in Wednesday’s after-hours session.

Inventory has a maximum of $ 1,794.99 in 52 weeks and a minimum of $ 211 in 52 weeks.

Dustin Blitchok contributed to this report.

The interior of the Model Y factory in Shanghai. Photo courtesy of Tesla.

Thanks for subscribing! If you have any questions, feel free to call us at 1-877-440-ZING or email us at [email protected]