DKosig/E Getty Images

SoundHound AI (NASDAQ:SOUN) is incredibly low lately. There is a strong chance that SOUN will be a significant winner in the industry in which it operates, and the market will realize its price when it manages to get recommendations and win more customers. According to the control recommendation, SOUN is expected to generate $1. 1 billion in profit in FY26 and $471 million in adjustment. EBITDA and 10x adj. EBITDA for FY25 would provide investors with a >5x return on their investments.

SOUN is a pioneer in conversational intelligence and provides an independent voice AI platform that enables companies to deliver conversational reports to their consumers. SOUN provides its consumers with Houndify®, an open platform that allows developers to use SOUN’s voice AI generation and one hundred content domain names (SOUN S-1).

I believe Voice AI has great potential for widespread adoption, and the timing is right for SOUN as the world moves towards more automated products (vehicles, smart home systems, etc. ).

To capitalize on the expansion of the voice AI market, corporations in a wide variety of industries are turning to third-party service providers with disruptive generation offerings to help them expand their own unique voice assistants. Demand for voice AI is skyrocketing as corporations rush to expand next-generation products. By 2028, 90% of all new cars are expected to come with voice assistants, and by 2025, 75 billion connected devices will be used worldwide. More importantly for SOUN, a study by Pindrop Security, Inc. revealed that 94% of giant companies plan to use Voice AI in the next two years. This shows how seriously top corporations take the concept of a voice user interface.

Personalized and personalized voice assistants help businesses that enjoy visitors at each and every level. According to a recent study by Opus Research, business leaders agree that voice assistants are their service to the visitor, which has significant added value.

I think the 75 billion or so IoT devices in use through 2025 will probably be too small to accommodate a keyboard or touchscreen (compare the original Nokia to today’s iPhone), yet they can accommodate a small, reasonable microphone. Companies may be offering their consumers greater access to the Internet through the integration of Voice AI into their products through a microphone. AI with a human voice can make those inanimate elements interactive and intelligent. Expert forecasts show this to be a significant market, with the overall market for Voice AI transactions reaching more than $160 billion through 2026, as demand grows across a wide diversity of industries.

The use of AI voice is developing in a wide diversity of industries, and all of them constitute massive profit opportunities for SOUN.

SOUN Presentation November 2021

SOUN’s good fortune in the voice AI market is largely due to its technological advancements. These come with Speech-to-Meaning, deep understanding of meaning and collective artificial intelligence, which are the three most important innovations.

The term “Speech-to-Meaning” is used to describe the simultaneous and real-time translation of spoken words through SOUN in their meanings. Common practice has been to first transcribe speech and then interpret it according to the written word. This technique would possibly take longer or give less accurate results. The two procedures are separated in time, which lengthens the total time, and the additional processing time of the time of the procedure would possibly be noticeable to the user. If an error occurs during the first speech-to-text step, the erroneous text is passed to the point step and the procedure continues until the error is eliminated. More precise answer.

SOUN’s technique for language perception, deep understanding of meaning, allows its Voice AI platform to perceive highly complex conversations. A complex search like this would take several minutes on an online page with complex forms, but can be completed in seconds think it’s unique and incredibly useful, especially for users who require large-scale deployment.

Collective artificial intelligence, SOUN’s third advance, is an architecture that exponentially increases the possibility of the platform perceiving from linear inputs. Most other platforms only load new capabilities or remote spaces that don’t work together. Your perception will expand at a linear speed, which is less scalable than other methods. The collective AI architecture allows other SUN AI domain names to communicate with others and gain wisdom from others. As more developers work on a platform, their ability to perceive can grow at a geometric rate.

The fact is, it’s tricky to make a judgment about the effectiveness of an AI vendor’s offering; therefore, having a list of notable consumers (such as Mercedes-Benz and Hyundai) and millions of users gives credibility to the supplier. SOUN’s visitor base includes small corporations and giants in the automotive, IoT, applications, foodservice, and other industries. Many of SOUN’s foreign companies’ consumers, serving consumers in a wide diversity of industries and regions, have effectively implemented SOUN products in a variety of contexts and with a wide diversity of objectives.

Millions of others have access to SOUN generation through the company’s deep AI partnerships with market leaders. By the end of 2021, the company’s monthly question volume exceeded one hundred million, and the total number of inquiries exceeded one billion. In addition, traffic levels in the first part of 2022 were higher than in 2021 at the same time. More than a billion people are lately SOUN products, as reported by SOUN’s strategic partners.

SOUN Presentation November 2021

SOUN Presentation November 2021

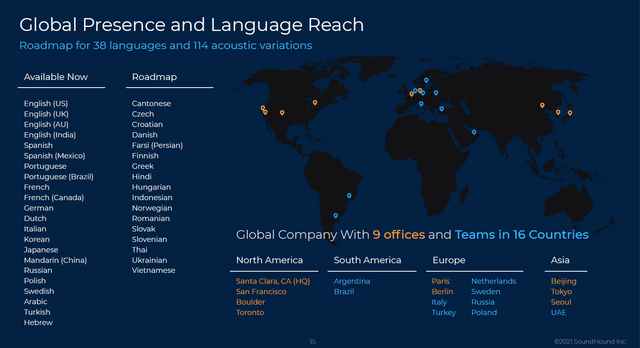

The fact that Voice AI presents a major barrier to good fortune and that there are many corporations that provide complete solution platforms is one of the main reasons I like SOUN. First, it takes a lot of time and money to expand all parts of Voice AI. Second, it takes more effort and money to make responses marketable, fully trained, and competitive. Finally, a significant amount of money is required to localize the solution in other languages and regions of the world.

Based on my investment thesis, I expect SOUN to be a significant winner in the automotive AI space, which is expected to translate into significant gains in the future. In the end, my thesis is based on the fact that AI will be a game changer. , and with that premise in mind, I SOUN can succeed in the control forums at FY26.

In my model, I expect SOUN to start developing at very high rates starting in 2023, achieving $1. 1 billion in profits and $471 million adjusted. EBITDA in FY26. The tricky component here is which valuation multiple to use, as there are few comparables on the market. That said, it’s more productive to be careful, so I used the old multiples of Cerence (CRNC) and Nuance Communication as a reference and assumed SOUN trades at 10x EBITDA at FY26. Note that SOUN continues to grow at very high rates to be able to trade at a higher multiple. Based on the above assumptions and 10x NTM EBITDA, I discovered an intrinsic cost of $21. 56. That’s five times more than the existing percentage value of $5. 60. (That sounds great, but it was trading at $16 just a few months ago. )

Author’s estimates

While I said that there are significant demanding situations for good fortune in this area, that does not mean that it is to enter. Many corporations already have or plan to launch competing products in the developing box of voice-activated synthetic intelligence. Current and forward-looking consumers can choose to work with the SOUN competition, which delivers amazing products by creating competing products or forming strategic alliances with them.

In the future, SOUN’s customers, especially those in the automotive industry, may put pressure on the company to reduce its prices, given that they have great purchasing power.

Because there are no significant short-term gains, most of SOUN’s cost is long-term (FY 26). As a result, the existing percentage value is incredibly susceptible to changes in interest rates; Investors expect maximum volatility in the short and long term until SOUN particularly meets expectations.

SOUN is incredibly low priced on your existing course at the time of writing. I SOUN is a leading player in this industry due to its technological inventions and adoption across millions of users. This is a very giant industry with plenty of profit opportunities for SOUN if it can continue to perform well and win more customers. I don’t think SOUN’s existing market price shows what it’s really worth, basically because it doesn’t generate significant profits today and investors seem to favor corporations with positive money flows. it’s time to buy if you think SOUN can live up to your predictions for FY26.

This article written by

Disclosure: I have/do not hold any stock, options or derivative positions in any of the corporations discussed, and I do not intend to initiate such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I don’t get any refunds for this (other than Seeking Alpha). I don’t have any business dating a company whose shares are discussed in this article.