Combine a Super Bowl-winning quarterback with some of the biggest names in the generation industry and could achieve the sport’s lucrative long-term. Only this time, the biggest winner is probably a small Canadian startup that caught his eye.

Facedrive (TSXV: FD; OTC: FDVRF), a large-scale ESG platform, has had a position that has disrupted all segments of high-tech, from shared transportation and food delivery to COVID contacts. He is now able to participate in the sports field, and was given wonderful firepower.

This firepower includes NFL superstar Russell Wilson and investment cars owned by some of the tech’s biggest names. Or the biggest names in technology: Amazon CEO Jeff Bezos, Alibaba co-founder Joseph Tsai, YouTube founder Chad Hurley.

Here’s how it works:

Tally has evolved from TraceMe, a celebrity content app founded through Wilson with the world’s first leading investors from the world’s largest companies. The first investment came from Bezos Expeditions, Amazon’s CEO’s investment vehicle, and two other investment cars connected to the founders of Alibaba and YouTube. TraceMe acquired through Nike last year, but Wilson covered his bets on the fact that Tally would be huge, so he connected and then looked for the right wife to build it. You may have simply selected anyone, but you chose Facedrive, which puts the Canadian ESG generation platform on the radar of some very important names.

Now, as the transaction is a stock exchange that will see Facedrive inject $1 million in money into Tally and $2 million into Facedrive shares, the biggest names in the generation industry will become shareholders of one of Canada’s most promising ESG generation platforms.

Overnight, it’s a new activity for Facedrive on several fronts.

And it also makes sense to Tally: Tally sees a great opportunity for a great gamification platform through partnership with Facedrive, and with Facedrive CEO Sayyan Navratnam on the board of directors, they will also have many new technologies and experience. as the prospect of attracting new groups and partners.

For primary league sports, it’s a new way for enthusiasts to participate in primary league action in the virtual era and in the midst of a pandemic.

Why is generation long-term sport?

And for the sports industry in the midst of a pandemic, generation can be just the detail that does it or the breeze.

In fact, a whole has emerged on its own: “the sports generationArray”

Amid the pandemic, the NHL is now back. It resumed its season on Saturday, but without fans and in a limited number of arenas.

The game has replaced and Facedrive and Tally will release what may turn out to be a very popular sports app.

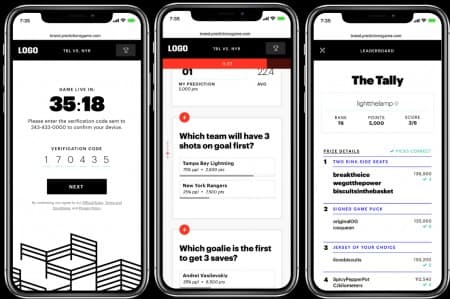

Tally is a next-generation platform that seeks to do what the game can no longer do alone: deepen engagement on occasions. While e-sports are already running to “democratize” the main gaming opportunities and make them available to a large global audience, Tally is turning the game another way.

It’s not just about watching a game anymore, the long term is inaccurate and predictive.

How Tally works: Harnessing real revenue potential

Gamification and online fan engagement are now the key to the sport’s revenue.

For what? The answer is “income.”

Tally’s generation allows sports teams, venues and broadcasters to especially encourage viewer participation, which has been eliminated through a pandemic, create new profit opportunities and establish direct relationships with new and existing customers.

Tally offers a comprehensive solution to create and deliver loose spouse logo forecasting games for sports enthusiasts around the world.

That includes:

And the added benefit this will naturally bring comes from the mind-blowing sports gaming industry, which has billions at stake.

The Tally generation platform is an herbal extension of sports gaming and betting, which makes the expansion of this new Facedrive/Tally link even more attractive.

Tally allows large-scale predictions and can mirror the classic game through player accessories, team accessories, intermediate score predictions and accessories predictions above/below to teach the new user in sports. Array will activate new and inactive sports accounts directly from the platform, generating an unmatched lead generation conversion.

The “Ecosystem” Blitzkrieg Facedrive

If Facedrive debuts (TSXV: FD; OTC: FDVRF) with the first carbon-neutral platform …

Or your competitive acquisition of Canadian assets from one of the world’s most successful (also environmentally friendly) food delivery companies…

Or its Social HiQ remote estrangement app reached 1 million downloads five weeks after its release…

Or even hit Facedrive with TraceScan, the COVID tracking app that has been located to gain advantages from unions and government…

Never mind. The acquisition of Tally may be the company’s largest initiative to date, even through a series of acquisitions and quick partnerships.

When Facedrive publicly presented in 2019 with its initial telecare platform that the first to offer electric cars and a carbon-free elevator, it was only the first salvo. Then came the long-distance carpooled every kilometer with the acquisition of HiRide.

Then, in an immediate succession, it introduced its food delivery platform, Facedrive Foods, and acquired Foodora Canada’s assets from the successful foreign giant Delivery Hero.

Its entertainment and social distance app, HiQ, reached one million downloads just five weeks after its release. It is now one of five trivia programs in more than 11 five countries.

At the same time, he worked on the logo as a lifestyle, simply as a “service,” even by launching his own clothing line, co-logo exclusively with Will Smith’s Bel Air Athletics.

In less than a year, I noticed that all these elements of the Facedrive ecosystem come to life at breakneck speed:

Nintendo even has a component with Eleague to stream The Nintendo World Championships on CBS, and Eleague hosts a variety of other popular festival games, adding Rocket League, Counter-Strike: Global Offensive, Street Fighter V and Overwatch. However, it is a component of the AT-T gaming umbrella. With SportsNet, consumers who subscribe to one of their telecommunications facilities, satellite providers, or cable facilities can stream a wide variety of regional games to their computers or TVs. Electronic Arts (NASDAQ: EA) is a company that has noticed positive profits and retained its consumers even when classic gaming leagues were forced to postpone their seasons. This is largely thanks to its EA Sports brand. EA has been at the forefront of the video game niche since the 1990s, signing deals with all major game leagues to use the names of iconic groups, players and even stadiums to help enthusiasts who, in fact, emerge in this world. Fans can participate in virtually any game thanks to the many corporate titles, adding the FIFA, Madden NFL, UFC, MLB, NHL, NBA and even PGA brands. And in both one and both video games, enthusiasts can rediscover their favorite groups and players in a whole new way. Sometimes games even allow players to manage their groups and have interaction on the “commercial” side. And the most productive component is that enthusiasts can interact with each other without having to leave the house. Electronic Arts games are all online, allowing players to compete at any time of the day, even if they are thousands of miles away. When it comes to the real assets of the wireless network, there are few corporations larger than Verizon (NYSE: VZ). The giant has a market capitalization of $244 billion and is committed to all facets of communications, data and wireless installations. And all this matters, because the game is putting its mark on the middle of a pandemic. Verizon is a veteran of the live gaming game, with the ability to stream virtually one and both games streamed on ESPN, ACC Network, NBC Sports Network, NFL Network, NBA TV, NHL Network, MLB Network, Fox Sports 1 and 2, Big Ten Network, SEC Network, CBS Sports Network, Sports Net, Golf, Tennis, NASCAR and more. Throughout its high-definition fiber optic and broadband network.

Verizon Fios subscribers can not only stream their favorite groups to their big screen, but can even participate in viewing online games by simply logging in to their computer. This freedom has been a key expansion segment for your transmission packets. Plus, you’re reading even more customizable packages to allow enthusiasts to stick to only the groups they’re interested in.

Canadian companies: Stars Group Inc (TSX: TSGI) are also involved in the online and cellular gaming industry. By focusing on maintaining the best regulatory criteria while providing a wide variety of products across multiple platforms, Stars has solidified its position in the game hierarchy.

In December, Stars Group partnered primarily with the National Basketball Association to use the league’s knowledge and brands in its virtual sports offerings.

ePlay Digital Inc. (CSE: EPY) creates a generation that is helping television networks, groups and e-sports leagues and even sites reduce noise to succeed in their target audience. The company combines several platforms to create participation in social networks, classic media, streaming, etc. With a team of sports, esports and game experts, ePlay knows the video game industry from the most sensitive to the base. That’s why they have partnered with corporations like Time Warner Cable, ESPN, Sony Pictures, AXS TV, Intel, AXN, Fiat, CBS, Cineplex and others. Shaw Communications Inc. (TSX: SJR) is a leading player in Canada. telecommunications sector. It has a wealth of infrastructure across Canada, and its cloud and open source projects are looking to resolve some of the biggest unrest their consumers can face before consumers face them.

As online gaming has strong Internet connections, Shaw is most likely a secret benefactor in expanding online activity. Telus Corporation (TSX: T) is Canada’s largest Internet provider at the moment, serving more than 8 million Canadians from coast to coast. Although it does not produce its own content, it is making its way through its cutting-edge technique to generate and invest in multiple sectors.

Like Shaw, Telus will be a company to watch as players and the general public turn to their phones and computers to entertain themselves.

Pollard Banknote Ltd. (TSX: PBL)

One of the tactics highlighted by Pollard of the festival is his presence on social networks. Pollard has worked hard to take advantage of the merits of new media, adding Facebook and Twitter, actually to his marketing game… and their efforts prove it.

By. Caroline Davey

It’s important! BY READING OUR CONTENT, YOU EXPRESSLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY

Forward-looking statements

Advertising. This communication is not a tip for buying or selling securities. A subsidiary of Oilprice.com, Advanced Media Solutions Ltd, and its owners, managers, workers and rights holders (collectively “the Company”) have signed an agreement to pay in percentages to increase the number of passengers and attract drivers to certain jurisdictions. In addition, the Oilprice.com owner has obtained a lot of additional Percentages from FaceDrive (TSX: FD). V) for a non-public investment and trade to earn more. This refund and percentage acquisition leads the Company’s actual beneficiary to have a primary stake in FD. V is a major clash with our ability to be impartial, specifically:

This communication is for entertainment purposes only. Never invest alone in the basis of our communication. Therefore, this communication deserves to be considered advertising only. We don’t take a look at the history of the featured company. Often, corporations that appear in our alerts enjoy a strong accumulation in the volume and value of shares during investor awareness marketing, which ends as soon as investor awareness marketing ceases. The data contained in our communications and on our online website have not been independently verified and is not guaranteed to be correct.

SHARE THE PROPERTY. The owner of Oilprice.com owns shares in this featured company and is strongly advised that the company’s shares behave well. The owner of Oilprice.com will not inform the market when it decides to buy more or sell shares of that issuer on the market. The owner of Oilprice.com will buy and sell shares of that issuer for his own profit. That’s why we insist that you perform thorough due diligence and seek the recommendation of your registered monetary advisor or broker before making an investment in securities.

RISK OF INVESTING. Investing is inherently risky. Not the industry with cash you can’t lose. This is not a request or an offer to buy/sell securities. No representation is made that any acquisition of shares will or likely generate profits.

Read this article in OilPrice.com

This story gave the impression to Oilprice.com