“r. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

Volatility is back. Markets have plummeted for 3 consecutive sessions, as the extended rally of the sun appears to be at a sloping point; however, for investors in one of the best performing newcomers of 2020, the short week began with a push.

The shares of truck manufacturer EV Nikola (NKLA) today soared to 42%, after the company announced that it had signed a new agreement with automotive giant General Motors.

By sending shockwaves across the street, the terms of the agreement stipulate that GM will gain an 11% stake in Nikola and the right to appoint a director to the board. In return, Nikola will have in his hands GM battery and mobile fuel generation and infrastructure, which will be used to produce the Badger, Nikola’s soft truck, and the company’s semi-trailer models.

Wedbush analyst Daniel Ives called the deal “a great condiment for Nikola,” and said the appointment would give the company much-needed credibility. The absence so far has focused on the impetuous personality of founder Trevor Milton and the question of whether Nikola can offer what lately is not much more than much publicity, you see believe that the “possible game change agreement” can greatly adjust Wall Street’s belief about the start of the automotive industry.

“There have been many skeptics around the ambitions of Nikola and its founder Trevor Milton in the coming years, who are now thrown out the window with the brave GM making a main strategic bet on Nikola for the next decade on electric vehicle and mobile fuel. front, ” said a 5-star analyst. ” For GM, given its strategy in generating electric batteries in the coming years and its large $20 billion investment in electric and autonomous cars until 2025, we see this as a wise strategic bet on the right for Nikola, although it remains a story of execution in the coming years in the eyes of the street, GM news is turning the company’s paradigm around its long-term ambitions into vehicles electric and mobile fuel.

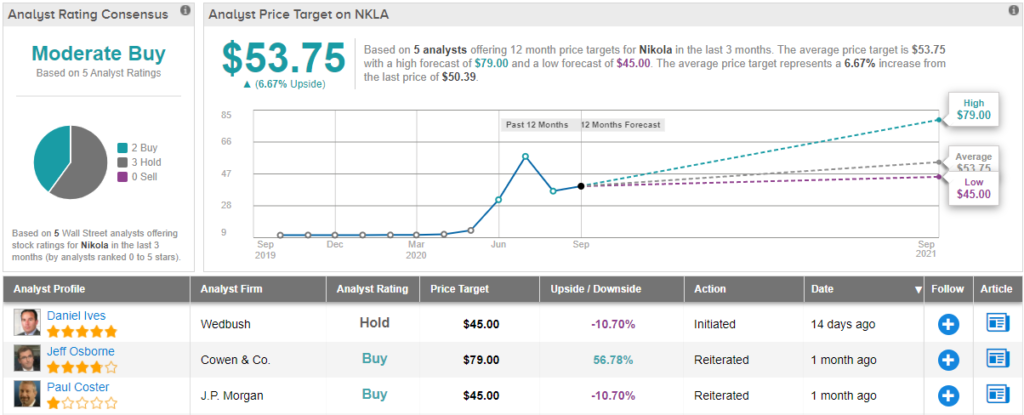

Yet despite the “big leap forward,” Ives maintains his fair score and his $ 45 value goal. After Tuesday’s increase, the figure represents an imaginable disadvantage of 11%. (To see Ives’s charts, click here)

So that’s Wedbush’s opinion. Let’s move now to the rest of the street, where Nikola has a moderate buy consensus rating, based on 2 purchases and 3 takes. Upon reaching the average value target of $53. 75, analysts expect stocks to appreciate across approximately 7% of existing levels (see NKLA inventory research at TipRanks)

To locate intelligent inventory trading concepts with exciting valuations, check out inventories to buy from TipRanks, a newly introduced tool that collects all tipRanks stock data.

Disclaimer: The reviews expressed in this article are only those of the analyst presented. The content is intended for use for data purposes only. It is very important to do your own research before making any investment.