n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Mitsubishi Heavy Industries Ltd (MHVYF) recently announced an $80 dividend consistent with the share, payable on 0000-00-00, with an ex-dividend date of 2024-03-28. While investors eagerly await this upcoming payment, attention is also being paid to it. paid to the company’s dividend history, performance, and expansion rates. Using the knowledge of GuruFocus, let’s take a look at Mitsubishi Heavy Industries Ltd’s dividend functionality and assess its sustainability.

Warning! GuruFocus detected 7 precautions with MHVYF.

High-yield dividend in the gurus’ portfolio

This complicated chart allowed Peter Lynch to earn 29% annually for thirteen years.

How do you calculate the intrinsic value of a stock?

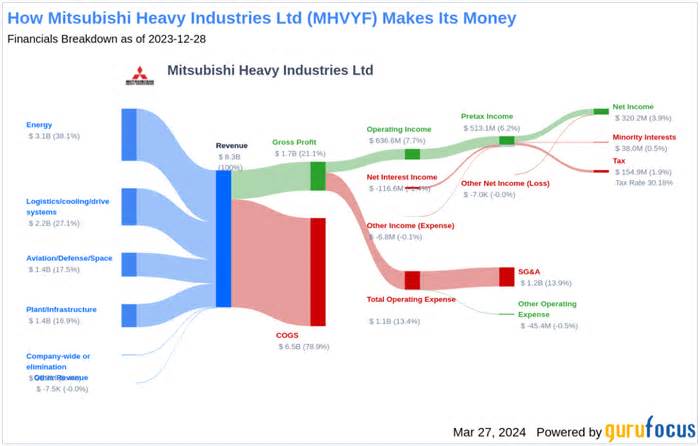

Mitsubishi Heavy Industries Ltd is engaged in the manufacture and sale of ships, advertising devices and aircraft. The company’s segments are Energy, Factories & Infrastructure Systems, Logistics, Thermal & Training Systems, and Aviation, Defense & Space. The company derives maximum profit from the force segment that manages white gas, steam power systems, nuclear power systems, compressors and marine devices. The company’s Plant Systems and Infrastructure segment deals with advertising vessels, engineering, device tools, and device systems; Logistics, thermal, and propulsion systems supply handling systems, engines, HVAC systems, and air conditioners for automobiles; and Aircraft, Defense, and Space covers advertising aircraft, defense aircraft, and others.

Mitsubishi Heavy Industries Ltd has maintained a consistent track record of paying dividends since 2013. Lately, dividends are distributed semi-annually. Below is a chart showing the consistent annual dividends with a percentage to track old trends.

As of today, Mitsubishi Heavy Industries Ltd has an existing 12-month dividend yield of 1. 11% and a forward 12-month dividend yield of 1. 28%. This leads to increased dividend payouts over the next 12 months.

Mitsubishi Heavy Industries Ltd’s dividend yield of 1. 11% is near its lowest level in 10 years and underperforms compared to 65. 04% for its global industrial competitors, suggesting that the company’s dividend yield would arguably not be a compelling proposition for investors as a source of income.

For the past 3 years, Mitsubishi Heavy Industries Ltd’s annual dividend expansion rate has been -4. 70%. Extended to a five-year horizon, this rate has been higher than 5. 60% consistent with the year. And over the past decade, Mitsubishi Heavy Industries Ltd. ‘s annual dividend expansion rate. The annual dividend consistent with the percentage expansion rate was 2. 50%.

Based on Mitsubishi Heavy Industries Ltd’s dividend yield and five-year expansion rate, Mitsubishi Heavy Industries Ltd’s five-year percentage yield has lately been around 1. 46%.

To assess the sustainability of the dividend, it will be necessary to assess the company’s dividend payout ratio. The dividend payout ratio provides information about how much of the company’s earnings it distributes as dividends. A lower index suggests that the company keeps a significant portion of its profits. , ensuring that there is a budget in place for long-term expansion and unforeseen recessions. As of 31/12/2023, the dividend payout ratio of Mitsubishi Heavy Industries Ltd is 0. 25.

Mitsubishi Heavy Industries Ltd’s profitability rating gives an idea of the company’s earnings compared to its peers. GuruFocus ranks Mitsubishi Heavy Industries Ltd’s profitability at 6 out of 10 as of 31/12/2023, suggesting fair profitability. The company has posted a net profit in nine of the last 10 years.

To ensure the sustainability of dividends, a company must have established growth indicators. Mitsubishi Heavy Industries Ltd’s expansion rating of 6 out of 10 suggests that the company has moderate growth prospects.

Revenue is the lifeblood of any business, and Mitsubishi Heavy Industries Ltd’s earnings consistent with participation, combined with the 3-year earnings expansion rate, indicate a profit model. Mitsubishi Heavy Industries Ltd’s earnings grew by about 1. 30% consistent with the year on average, a lower rate than about 70. 39% of its global competitors.

The company’s 3-year EPS expansion rate demonstrates its ability to grow earnings, a critical detail to sustain dividends over the long term. Over the past 3 years, Mitsubishi Heavy Industries Ltd’s profits have grown by approximately 14. 40% on average, consistent with the year, an inconsistent formation rate for around 46. 62% of its global competitors.

To conclude our analysis, Mitsubishi Heavy Industries Ltd’s dividend payouts, while consistent, provide a mixed picture in terms of performance attractiveness and expansion prospects. The modest payout ratio indicates a balance between rewarding shareholders and retaining profits for long-term projects, which is corroborated through the company’s equitable profitability and expansion. However, the below-average dividend yield and combined functionality in earnings and earnings expansion relative to its industry peers deserve careful attention from price investors. As the landscape of the commercial products sector evolves, it will be critical to monitor how Mitsubishi Heavy Industries Ltd adapts and whether its dividend strategy aligns with broader market trends and investor expectations.

GuruFocus Premium users can search for stocks with higher dividend yields on the High Dividend Yield Screener.

This article, generated through GuruFocus, is designed to provide general data and does not constitute personalized monetary advice. Our observation is based on old knowledge and analyst projections, employs an unbiased methodology, and is not intended to serve as express investment advice. It makes recommendations for buying or selling stocks and does not take into account individual investment objectives or monetary situation. Our purpose is to provide long-term, knowledge-based basic research. Please note that our research may not incorporate the maximum amount of information. Up-to-date, price-sensitive business ads or data. GuruFocus does not hold any position in the stocks analyzed here.

This article was first published on GuruFocus.