“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

(Bloomberg) – Big corporations go bankrupt at a record pace, but that’s just one component of carnage. There are some reports that small businesses are disappearing by the thousands amid the Covid-19 pandemic, and the economic downturn of those messes can be huge.

This wave of silent entanglements has an innumerable component because real-time knowledge of small businesses is notoriously scarce and because small business owners have no debts and therefore do not want a bankruptcy court.

“All you have to do is call utility companies and tell them to shut them down and close the door,” said William Dunkelberg, who conducts a monthly survey as a leading economist with the National Federation of Independent Enterprises. However, the closures “are going to be way above and for all because we are in a desperate economic situation,” Dunkelberg said.

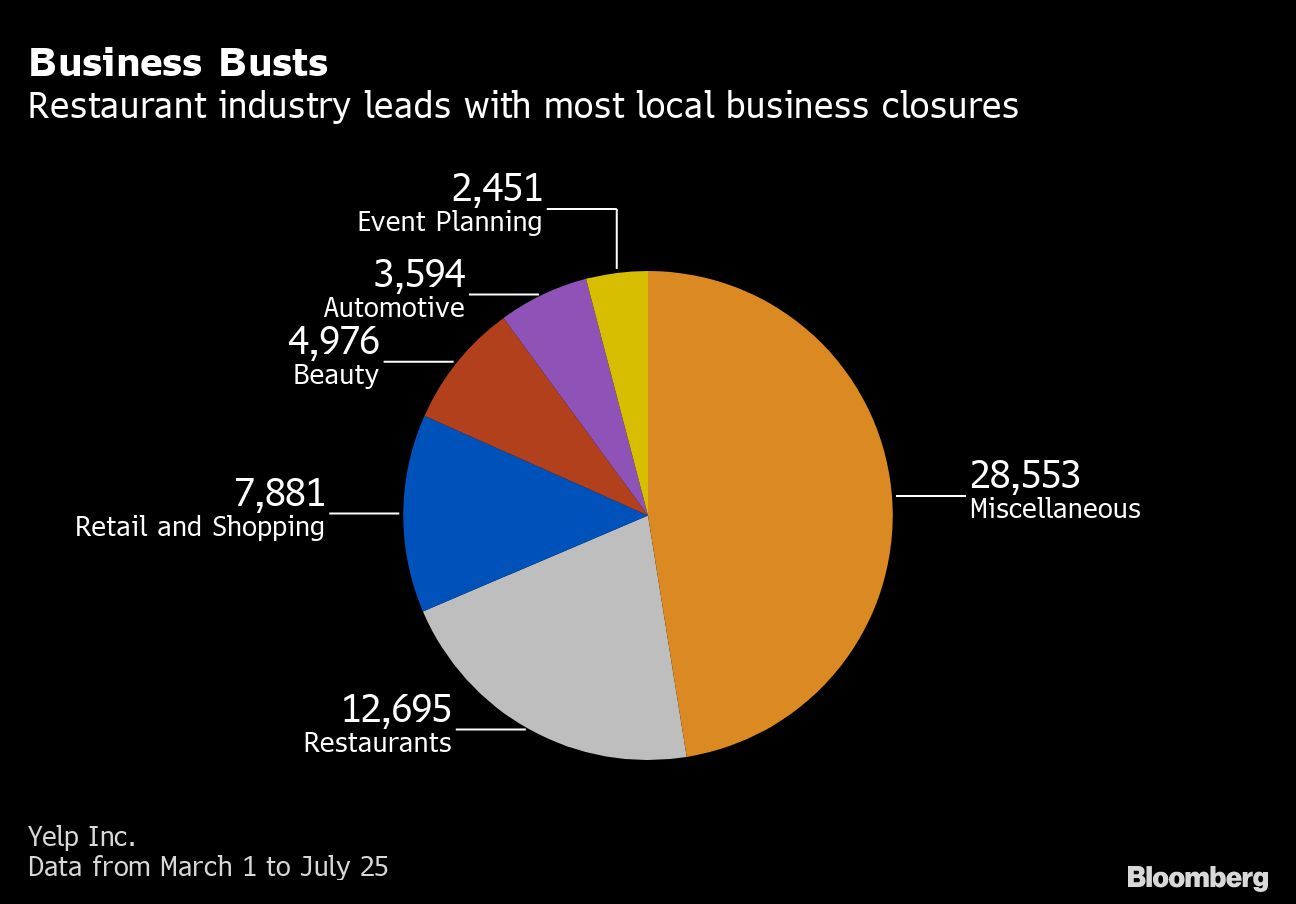

Yelp Inc., the online critic, is aware that more than 80,000 permanent closures have appeared from March 1 to July 25. About 60,000 were local businesses or businesses with fewer than five locations. According to the American Bankruptcy Institute, about 800 small businesses took over Chapter 11 of bankruptcy from mid-February to July 31, and the industry organization expects 2020 overall to be 36% more than last year.

Although corporations are small individually, the collective effect on their mistakes can be considerable. Companies with fewer than 500 workers account for about 44% of U.S. economic activity, according to a U.S. Small Business Administration report, and employ nearly a portion of all U.S. workers.

Justine Bacon has permanently closed her Yoga Brain studio in Philadelphia after deciding that it is too harmful to keep categories indoors due to the pandemic. Bacon did not file for bankruptcy, simply closed the store and filed for bankruptcy on June 30.

“I think it’s better to close with some cash on the bill and not have to worry about the bankrupt,” said Bacon, 35.

It doesn’t help

Bankruptcy 11 bankrupt provides opposing corporate coverage to its creditors as owners extend a restructuring plan. For small businesses, however, it may not make a difference. “Bankruptcy can’t generate more revenue,” said Robert Keach, a restructuring spouse for Bernstein Shur, a former president of the New England-based American Bankruptcy Institute.

Some homeowners are concerned that bankruptcy will harm their credit reports and jeopardize their long-term chances of reconstruction. Bankrupt corporations have a higher chance of being denied a loan by approximately 24 percentage points, according to the SBA, and possibly a record would appear on a 10-year credit report.

This is one of Rebecca Schner’s concerns. Things were getting better for Schner, 51, and his jewelry boutique and fairground New Lotus Moon in The Woodlands, Texas. It opened in 2018 and, however, began to reach the equilibrium point before this year.

Then came the virus. After the store closed down customers who entered without an appointment, he said sales had dropped and could cover the rent. He emptied the store in mid-May, stocked his jewelry boxes and fired his part-time employee. It makes minimum bills of approximately $50,000 in loans.

“What if I have a cell phone store and buy a vehicle for that? Can I get a loan?” said Schner.

Loss of income

Certainly, the wear and tear of small businesses is superior even in general times. Only part of all institutions for at least five years, according to the SBA. But the speed of the pandemic and the massive decline in economic activity hit sometimes positive marketing specialists hard. About 58% of small business homeowners say they are concerned about the final closure, according to a July survey conducted through the U.S. Chamber of Commerce.

In a June 2020 NFIB survey, 31% of net homeowners reported a decline in sales in the last 3 months, while 7% reported higher sales a year earlier. In the same survey, only 13% of commercial homeowners said it was the right time to grow, up from 24% the previous year.

José Gamiz, 45, and Leticia Gamiz, 52, closed their place to eat in Glendale, Arizona on July 31. The bills were piled up, and while thousands of government loans helped, they didn’t get enough money. They had four part-time employees.

It was too complicated to keep My Vegan Mother open, José Gamiz said. The couple knew the dangers of racing after wasting the first house they bought during the 2008 crisis.

“We tried to take this as a lesson,” José Gamiz said. “Sometimes it’s usual to give up and not spend every penny.”

For more items like this, please visit bloomberg.com

Subscribe now to forward with the ultimate source of reliable business news.

© 2020 Bloomberg L.P.