n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Revenue: $136. 5 million (down 4. 2% from FY 2022).

Net income: $15. 9 million (down 26% from fiscal 2022).

Profit margin: 12% (vs. 15% in FY2022).

EPS: $0. 21 (vs. $0. 30 in FY 2022).

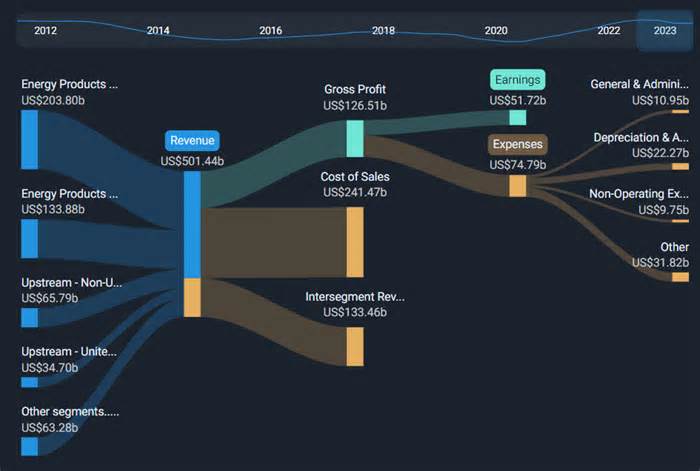

All figures shown in the chart above are for the 12 months (TTM).

Looking ahead, revenue is expected to grow 4. 5% consistent with the year, on average over the next 3 years, at an expected expansion of 11% for the metals and mining industry in Canada.

Performance of the Canadian mining and metals industry.

The company’s shares are up 3. 0% from a week ago.

Read about the 2 precautionary symptoms we have detected at Jaguar Mining.

Any comments on this article? Worried about the content?Contact us directly. You can also email the editorial team(at) Simplywallst. com. This article from Simply Wall St is general in nature. We provide observations based on old knowledge and analyst forecasts that employ only unbiased methods and our articles are not intended to constitute monetary advice. It is not advice for buying or selling stocks and does not take into account your purposes or monetary situation. Our purpose is to provide you with specific, long-term research based on basic knowledge. Please note that our research may not take into account the latest announcements from price-sensitive companies or qualitative factors. Simply put, Wall St does not have any position in any of the stocks mentioned.