n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

Before we talk about the reliability of brokerage recommendations and how to use them to your advantage, let’s take a look at what those Wall Street heavyweights think about General Motors Company (GM).

General Motors Company has lately an average brokerage advice (ABR) of 1. 83, on a scale of 1 to five (strong buy to hard sell), calculated on actual advice (buy, hold, sell, etc. ) made through 21 brokerage firms. . An APR of 1. 83 is close to strong buying and buying.

Of the 21 recommendations that are derived from the existing ABR, 12 are purchases and two are purchases. Strong buys and buys account for 57. 1% and 9. 5% of all recommendations, respectively.

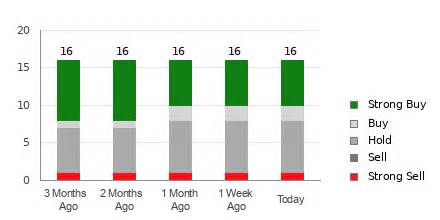

Trends in GM Brokerage Recommendations

Check price target & stock forecast for General Motors Company here>>>The ABR suggests buying General Motors Company, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Wondering why? The direct interest of brokerage firms in an inventory they cover produces a strong positive bias in their analysts’ component of their rating. Our studies show that for each and every “Strong Sell” recommendation, brokerages assign five “Strong Buy” recommendations.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock’s future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.

With an impressive externally audited track record, our proprietary inventory scoring tool, Zacks Rank, which classifies inventories into five groups, ranging from Zacks Rank No. 1 (Strong Buy) to Zacks Rank No. 5 (Strong Sell), is a reliable indicator of a stock’s short-term value performance. Therefore, validating the Zacks range with ABR can be of great help in making a successful investment decision.

ABR deserves not to be in Zacks Rank

Although the Zacks Rank and ABR are displayed in a range of 1 to 5, they are completely different metrics.

The ABR is calculated solely on the basis of the brokerage’s recommendations and is displayed with decimal put options (example: 1. 28). In contrast, Zacks Rank is a quantitative style that allows investors to harness the strength of earnings estimate revisions. It shows total numbers – from 1 to 5.

It has been and continues to be the case that analysts hired through brokerage firms are overly positive in their recommendations. Because of the vested interests of their employers, those analysts give more favorable ratings than their studies would allow, thus deceiving investors far more than they would help them.

On the other hand, revisions to earnings estimates are at the center of Zacks’ rankings. And empirical studies show a strong correlation between trends in earnings estimate revisions and short-term stock value movements.

In addition, Zacks ratings are implemented proportionally to all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, this tool maintains a balance between the five ranges it assigns at all times.

Another key difference between ABR and Zacks Rank is freshness. The ABR may not be up to date when viewed. But, since brokerage analysts continue to revise their earnings estimates to account for adjustments in a company’s trading trends and its stock. are reflected in Zacks’ ratings fairly quickly, it’s a good idea to show long-term price movements.

Is GM Worth Investing In?

In terms of earnings estimate revisions for General Motors Company, the Zacks Consensus Estimate for the current year has increased 17.2% over the past month to $8.83.

Analysts’ growing optimism about the company’s earnings outlook, as indicated by the strong agreement among them on revising EPS estimates upwards, may simply be a valid explanation for why inventory will increase in the near term.

The duration of the recent consensus estimate upgrade, along with three other similar earnings estimate upgrades, have resulted in a Zacks Rank #2 (Buy) for General Motors Company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here >>>>

Therefore, General Motors Company’s purchasing ABR can serve as a useful consultant for investors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research