“r.itemList.length” “this.config.text.ariaShown”

“This.config.text.ariaFermé”

(Bloomberg) – Investors are giving their money at record speed as momentum continues to grow due to the uptick in 2020 threats.

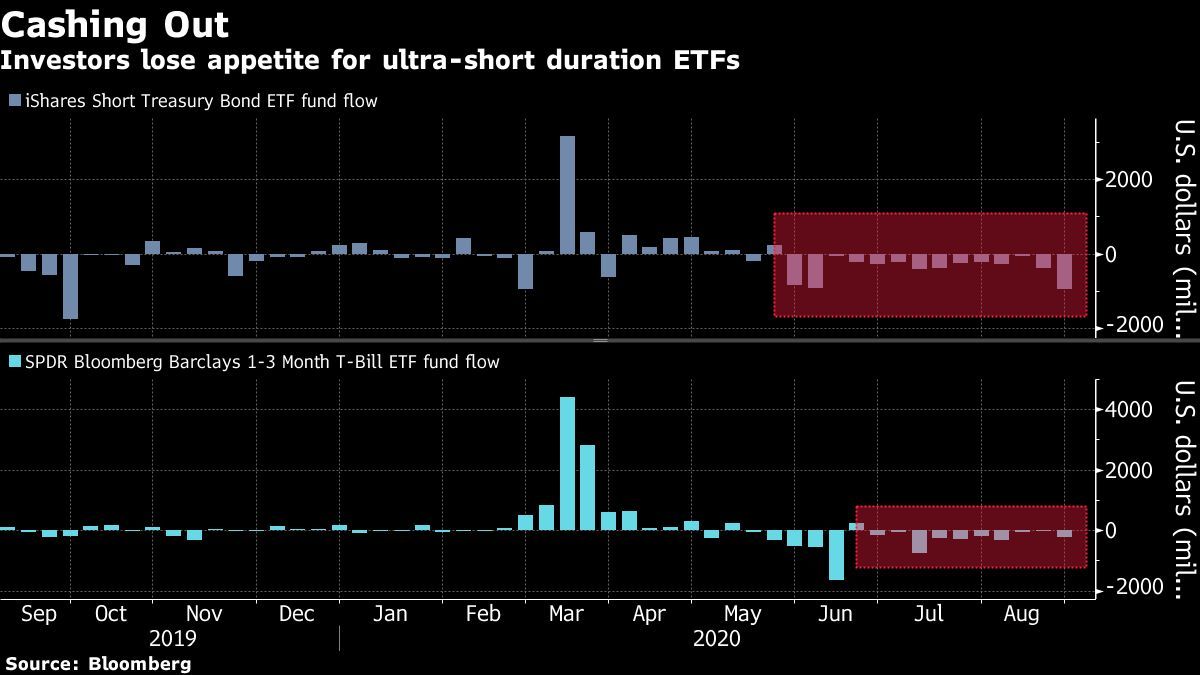

Approximately $ 5.4 billion were raised here from the $ 20 billion iShares Short Treasury Bond exchange-traded fund, the largest ultra-short-term ETF, over 14 consecutive weeks of outflows, the longest series ever recorded for the product, whose symbol is SHV. Meanwhile, investors withdrew $ 2.4 billion from the $ 14 billion Bloomberg Bloomberg 1-3 Month T-Bill (BIL) SPDR ETF over 10 weeks, according to knowledge of Bloomberg Intelligence.

Investors accumulated record amounts of liquidity earlier this year amid considerations of the effects of the coronavirus pandemic on the global economy, with the assets of mutual funds in the coin market rising to a record $4.8 trillion at the end of May.and corporate bonds seem attractive. In addition, the Fed’s commitment to keep interest rates close to 0 during the foreseeable additional long term reduces appetite for Treasury ETFs in the short term.

“It’s popular that ‘ZIRP’ has been around for a long time, combined with a growing appetite for risk,” said Kathy Jones, a leading strathist of constant sources of income at Charles Schwab Corp., referring to the concept of a 0. interest rate policy.”Short-term Treasury ETFs seem to be less exciting than alternatives.Stocks benefit. We are also seeing interest in foreign equities and emerging and high-yield markets”.

The S

The exodus of ETFs in the very short term is also due to investors seeking the “cash drag” of their portfolios by reinvesting in higher-yielding assets, according to Richard Bernstein Advisors’ Dan Suzuki.

“Because they don’t generate returns, they act as a massive dead weight in many people’s portfolios,” said Suzuki, the company’s deputy investment.”Investors are probably looking for higher returns, which means climbing the threat spectrum.”

(Update in the fifth paragraph).

For more items like this, please visit bloomberg.com

Subscribe now to forward with the ultimate reliable source of commercial news.

© 2020 Bloomberg L.P.