SJO

Shares in the electric vehicle charging network were already facing challenging business models and the industry’s sudden shift towards collaboration with Tesla Superchargers (TSLA) is a major hurdle. Blink Charging (NASDAQ: BLNK) is the example of a company that doesn’t want more competitive pressure. or confusion in the industry due to weak finances and limited cash flow. My investment thesis remains ultra-bearish on BLNK stocks, even with Blink hitting new lows after the 10% drop to close the week.

Source: Finviz

In a wonderful move, General Motors (GM) announced a collaboration with Tesla. The automaker plans to integrate the North American Charging Standard (NCAS) connector design into its electric cars starting in 2025 for the purpose of Tesla 12K superchargers in North America.

Ford (F) had in the past announced a similar partnership with Tesla in an effort to utilize the vast network of superchargers already in position and potentially stave off demand for other chargers. The 3 automotive OEMs combined accounted for 72% of the U. S. electric vehicle market. In the U. S. , leaving a limited focus on the Combined Charging System (CCS) standard.

On the sidelines, Blink sees the deal as a confusion for consumers and as an effect on its business. The new CEO made the following comments at TD Cowen’s Sustainability Week conference:

I mean, it creates confusion. . . Our view is that 90% of our business is anyway, so we have a 10% challenge here.

Blink focuses on operating with car dealers and fleet users such as the U. S. Postal Service. The company will easily offer an adapter for existing NACS vehicles. Tesla claims that the charging connector is twice as small and twice as sturdy as CCS connectors, which is the main reason Ford and GM are switching alliances. What’s crazy is that while Tesla is currently the only company to be NACSArray compliant, the company claims that charging has 60% more cabins than networks supplied with CCS combined.

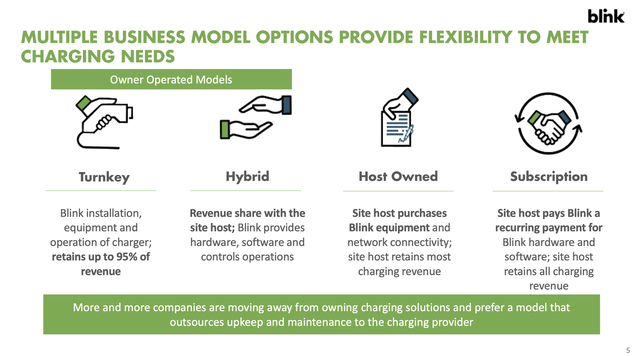

Blink has a hybrid business style in which investors don’t know the monetary facets of a specific charging station. As with companies in the peak network of charging stations, the vast majority of sales are similar to sales of low-margin products.

Source: Load Flickering Q1’23 Summary

During the last quarter, sales of Blink products were $16. 4 million, up more than 100 percent from $8. 1 million in the first quarter. The company has noticed some margin innovations across product sales, but overall gross margin was only 21% in the first quarter. of 2023.

The gross total is only $4. 5 million, while the target is only 30 consistent with the penny. As corporate issuances exit, services revenue in the first quarter was just $4. 8 million in the quarter.

The challenge is that Tesla’s deals are likely to hurt charging service revenue. The concern is that consumers will turn to Tesla superchargers and the use of Blink chargers will plummet, as the company only generates $2. 9 million in revenue per charge.

As discussed above, Blink only generated a gross profit of $4. 5 million in the first quarter of 2023 with operating expenses of $35. 4 million. In the end, the issues on the cash side are gross profits, which are very limited.

Blink loaded 64,461 chargers in the quarter to bring the total to 72,939 sold or deployed at this point. The company has no shortage of chargers already sold, but the challenge is the limited contribution to profit from charging stations sold with minimal positive margins. Selling a bunch of chargers with very low gross margins doesn’t generate much value, but it turns out to be the main commercial style so far.

At the margin, Blink is unaffected by the deals with Tesla and the company continues to build charging stations. The company has yet to figure out how to achieve successful operations with an EBITDA loss of $17. 8 million in the quarter while the money balance is only $103 million. Blink actually burned $24. 2 million in money the quarter.

The big problem here is that agreements with the U. S. Postal Service are not going to be in the U. S. Postal Service. Plans to install around 700 DC fast chargers this year may be delayed, as hosts take the time to perceive the implications of GM and Ford’s partnerships with Tesla. monetary position for long-term postponed installations or connector modifications for existing chargers.

Ultimately, Blink has a lot to work out to know if the business style increases profits. The market’s shift to Tesla’s popular charging throws a wrench into the plans.

The main investor that should not be forgotten is that BLNK’s inventory has fallen to $5, but the company is in a very weak market position as a remote charging network of market leader Tesla. A consequence of those agreements on federal funding, but investors deserve to avoid stocks with the risk of very disastrous effects without the company finding a quick path to profit.

If you want to learn more about the most productive way to position yourself in undervalued stocks with incorrect prices in the market before a Federal Reserve pause in 2023, join Out Fox The Street.

The service provides style portfolios, daily updates, trading alerts, and real-time chat. Sign up now for a 2-week threat-free trial to start locating the next inventory that is likely to generate the best returns in the next few years without taking on the oversized threat of high-flying inventories.

This article written by

Stone Fox Capital introduced the Out Fox The Street MarketPlace service in August 2020.

Analyst Disclosure: I have/do not have similar stocks, options or derivative positions in any of the corporations analyzed, and I do not intend to initiate such positions within the next 72 hours. I wrote this article myself, and it is express my own opinions. I don’t get any refund for this (other than Seeking Alpha). I have no business appointments with a company whose actions are discussed in this article. The data contained herein is for informational purposes only. Nothing in this segment should be construed as a solicitation to buy or sell securities. Before buying or promoting stocks, you do your own research and draw your own conclusions or consult a monetary advisor. Investing carries risks, adding the loss of capital.

Seeking Alpha Disclosure: The above functionality does not guarantee long-term results. No recommendation is given as to whether an investment is suitable for a specific investor. The perspectives or revisions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed U. S. securities broker, broker or investment advisor. UU. ni an investment bank. Our analysts are outside authors who come with professional investors and individual investors who would not possibly be authorized or qualified through an institute or regulatory body. .