n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

Industry-average functionality has declined: the increased use of SMS has been offset by a lower speed and quality of phone and email responses.

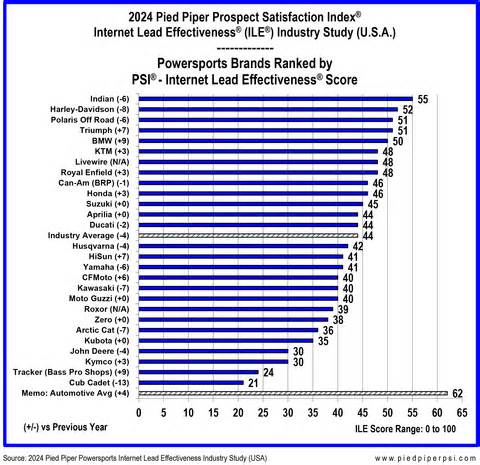

MONTEREY, Calif. , April 8, 2024–(BUSINESS WIRE)–Polaris Inc’s Indian motorcycle dealers were ranked number one in the 2024 Pied Piper PSI® Internet Lead Effectiveness® (ILE) ® study, which measured responsiveness to future prospects. on powersports dealer websites. This is followed by Harley-Davidson, Polaris Off-Road, Triumph and BMW from India.

Pied Piper sent mystery shopper inquiries through the individual Internet sites of 3,718 powersports dealerships, making an express inquiry about a vehicle in stock and offering a visitor’s unique name, email address and local phone number. Pied Piper then evaluated how dealers responded to email, phone and text messages over the next 24 hours.

The powersports industry’s average ILE functionality has declined over the past year. “2024 is a much more challenging business environment for powersports distributors,” said Fran O’Hagan, CEO of Pied Piper. “New virtual retail teams and effective web-based reaction processes are more prevalent post-pandemic, yet powersports distributors are struggling to retain skilled workers to use those teams and processes effectively. “

Twenty other quality and speed of reaction metrics generate ILE scores for distributors, ranging from 0 to 100. Distributors with a score above 80 offer a quick and thorough private response via email and phone, and also via SMS. , dealers with a score below 40 do not respond privately to consumers on their website. For Indian Motorcycle, the top-rated dealerships, 24% of their dealers scored above 80, while 32% scored below 40. The powersports industry showed that only 14% of dealers scored above 80, while 43% scored below 40. “The effort is worth it,” O’Hagan said. On average, dealers with a score above 80 sell 50% more cars to the same number of consumers on their website, compared to dealers with a score below 40. “

The brands that saw the biggest improvement over last year are BMW, Triumph, Honda and Royal Enfield. The functionality of 11 out of twenty-seven brands decreased. The brands with the biggest declines were Kawasaki, Arctic Cat, John Deere, Harley-Davidson and Yamaha.

This year, distributors were more likely to respond to online visitor inquiries via SMS than in previous years. However, the increase in the use of text messages was negatively offset by reduced functionality through other communication channels. Quick responses over the phone were less common, and the use of email to answer visitors’ questions was down compared to last year. Distributors across the industry also responded by minimizing quality content on average compared to last year, with only 3 out of 16 content metrics improving from last year. Numbers of the year.

The most successful dealerships respond to their internet customers through multiple channels (text, phone, email) to prevent their customers from running out of an email or text message or not answering their phone. In this year’s study, 26% of dealers responded through multiple channels, compared to 27% last year. A smaller group, 15% of distributors, not only responded across multiple channels, but did so within 30 minutes, up from 17% last year.

Responding to visitors’ inquiries on the internet through the logo and dealership, and here are examples of functionality variation through the logo:

How have the brand’s distributors sent an email reaction to a customer’s inquiry from a website?

More than 50% of the time on average: Moto Guzzi, Indian, BMW

Less than 25% of the time on average: Livewire, Kymco, Yamaha, Zero, Tracker

How have brand distributors sent an SMS reaction to a customer’s request from a website?

More than 30% of the time on average: Royal Enfield, Harley-Davidson, Livewire, Triumph, Zero, Indian

Less than 10% of the time on average: Kubota, John Deere, Kymco, Cub Cadet, Tracker

How have the brand’s dealers responded by phone to a customer’s request from a website?

More than 50% of the time on average: Tracker, Livewire, Harley-Davidson, Indian, Suzuki, BRP

Less than 25% of the time on average: Roxor, John Deere, Cub Cadet

“They did both”: How did the brand’s distributors respond via email or text message to a customer’s inquiry from an online page and also respond via a phone call?

More than 30% of the time on average: Harley-Davidson, Indian, Livewire

Less than 10% of the time on average: Cub Cadet, Tracker, Kymco

“Have you made at least one?” – How have the brand’s distributors responded via email or text message to a customer’s inquiry from an online page and/or responded by phone?

More than 80% of the time on average: Royal Enfield, Indian, KTM

Less than 60% of the time on average: Kymco, John Deere, Zero, Cub Cadet

“Today, 3 out of 10 internet motorsports consumers who ask about a vehicle will be misled by the dealership,” O’Hagan said. “Today, a TooArray dealer’s reaction is nothing, or just an automatic reaction, the fashionable equivalent of a shaped letter. ” Pied Piper has found that the key to getting better reaction on the website and, as a result, increasing sales, is to show distributors what consumers are actually experiencing on their website, which is a surprise.

The Pied Piper PSI® Internet Lead Effectiveness® (ILE) ® studies have been conducted annually since 2011. The 2024 Pied Piper PSI-ILE (U. S. A. Powersports) exam was conducted between May 2023 and February 2024 by submitting online page queries directly to a patron of 3,718 dealerships nationwide representing all major powersports brands.

About Pied Piper Management Company, LLC

Founded in 2003, Pied Piper Management Company, LLC is a Monterey, California-based company that helps drive its retailers’ omnichannel sales and service functionality by building fact-based productive practices and then measuring and reporting on functionality. The studies conducted by Pied Piper PSI are the 2024 Pied Piper PSI® ILE® automotive industry study (Nissan’s Infiniti logo ranked first) and the 2023 Pied Piper Service Teletelephone Effectiveness® (STE) ® powersports industry study (Harley-Davidson ranked first). ranked first). The full effects of Piper’s PSI® industrial foot study are provided to automakers and national broker groups. Manufacturers, national runner groups, and individual runners also commission PSI® testing (in person, over the internet, or over the phone) as equipment to measure the efficiency of their brokers’ omnichannel sales and service. For more data on Pied Piper’s Lead Satisfaction Index and fact-based PSI® process, visit www. piedpiperpsi. com.

This press release is provided for editorial purposes only and the data contained in this press release may not be used for advertising or promotional purposes of the brands mentioned in this press release without the express written permission of Pied Piper Management Co. , LLC.

See the businesswire. com edition: https://www. businesswire. com/news/home/20240407227181/en/

Contacts

Ryan Scott(831) 648-1075rscott@piedpipermc. com