Great Panther Mining announced its quarterly effects last week with an improvement in prices and quarterly gold production at its Tucano mine.

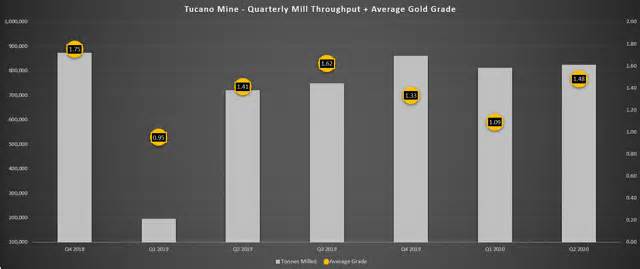

Quarterly gold production in Tucano 35,400 ounces, an 18% increase over last year.

The increase in sales volume has particularly reduced prices at the mine, and we have noticed consolidated all-inclusive maintenance prices below $1,200 consistent with the ounce.

Based on the significant improvement in the value of gold, I canceled my thesis to promote above $0.62 to speculatively acquire at $0.72.

We are now more than halfway through the quarter earnings season for the Gold Miners Index (GDX), and one of the first small gold manufacturers to publish their effects is Great Panther Mining (GPL). Although the company had a very complicated quarter in Mexico, consistent with government-imposed closures, Great Panther’s Tucano mine had a solid quarter, with 18% more ounces produced year after year. The improved effects have helped the company, particularly its all-inclusive maintenance costs, and the high consistency with the value of gold (GLD) will allow this former newcomer to generate at least $0.16 in annual earnings consistent with the consistent percentage (EPS) in fiscal year 2020. Based on particularly upward coherence with the value of gold, a new CEO in the post and a moderate valuation, I canceled my thesis to promote above $0.62 to a speculative acquisition at $0.72.

(Source: corporate website)

Great Panther Mining released its quarterly effects so far last week and announced a quarterly production of 38,500 GEO, 3% less than it was last year. On the other hand, all-inclusive maintenance prices have been particularly increased from $1,380/oz to $1,126/oz. Although this figure is still well above the industry average, it is a big step in the right direction, especially since the company’s Mexican operations have been temporarily put into care and maintenance due to COVID-19. Since the Mexican operations of the Gran Pantera have been closed with minimal input, we will only talk about the operational effects of Tucano in this article. In fact, the effects are not comparable to those of the past era in GMC and Topia with 40-day closures. Let’s take a closer look at the quarter below: