“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

– By Titian Frateschi

Gotham Asset Management, LLC of Joel Greenblatt (Trades, Portfolio) manages a $3.340 million equity portfolio consisting of 1,044 shares at the end of the quarter. The company sold shares of the following shares this quarter.

Warning! GuruFocus has detected 8 symptoms of caution with TJX. Click here to exit.

15-Year TJX Monetary Data

The intrinsic TJX

TJX Peter Lynch painting

TJX Companies

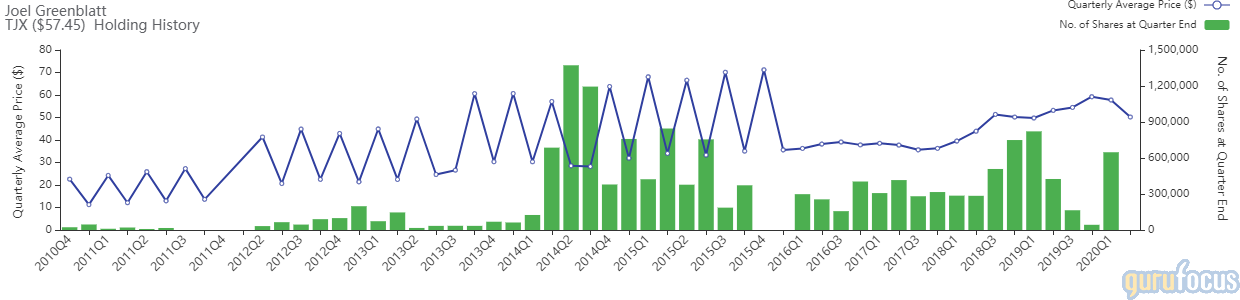

The fund closed its position at TJX Companies Inc. (TJX). Trading had an effect of -0.86% on the portfolio.

The company, which sells clothing, home fashion and other merchandise, has a market capitalization of $68.82 billion and a $81.04 billion business.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 31.5% equity yield and 7.07% return on assets exceed 84% of companies in the cyclical retail sector. Its monetary strength has a rating of 6 out of 10. The debt ratio of 0.26 is lower than the industry median of 0.46.

The company’s key shareholder is PRIMECAP Management (Trades, Portfolio) with 1.26% of the shares outstanding, followed by Diamond Hill Capital (Trades, Portfolio) with 0.47%.

Raytheon

The fund left its stake in Raytheon Co. (RTN) when the company merged with United Technologies to shape Raytheon Technologies (RTX). The portfolio had an impact of -0.72%.

Chevron

The fund reduced its position at Chevron Corp. (CVX) by 46.13%. The portfolio had an impact of -0.54%.

The built-in energy corporation has a market capitalization of $163.63 billion and a $191.04 billion business.

GuruFocus provides the company with a profitability and expansion score of 6 out of 10. The return to equity of -5.92% and the return to assets of -3.6% are under the yield of 52% of oil and fuel companies. Its monetary strength has a rating of five out of 10. The cash-to-debt ratio of 0.2 is lower than the industry median of 0.37.

The key shareholder is Ken Fisher (Trades, Portfolio) with 0.28% of the shares outstanding, followed by Diamond Hill Capital (Trades, Portfolio) with 0.19% and Barrow, Hanley, Mewhinney -Strauss with 0.17%.

Reservation

The fund reduced its position to Booking Holdings Inc. (BKNG) by 61.25%, impacting the portfolio by -0.53%.

The online company has a market capitalization of $72.84 billion and a commercial price of $74.46 billion.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The 5 0.83% return on equity and the return on assets of 12.34% exceed 9 4% of companies in the and recreational sectors. Its monetary strength has a rating of five out of 10. The indebtedness rate of 0.87 is double the industry median of 0.44.

The company’s key shareholder is Dodge-Cox with 3.60% of the shares outstanding, followed by Steve Mandel’s Lone Pine Capital (Trades, Portfolio) with 1.46% and Pioneer Investments (Trades, Portfolio) with 0.64%.

3m

The investment fund reduced its share of 3M Co. (MMM) by 70.06%, impacting the portfolio by -0.50%.

The company has a market capitalization of $94.69 billion and a business of $111.90 billion.

GuruFocus provides the company with a profitability and expansion score of nine out of 10. The return to equity of 4.9% to 5% and the return on assets of 11.8% exceed 9% of companies in the commercial products sector. Its monetary strength has a rating of five out of 10. The debt ratio of 0.21 is lower than the industry median of 0.94.

The gur guru shareholder is Fisher with 0.77% of the shares outstanding, followed by First Eagle Investment (Trades, Portfolio) with 0.51% and Jeremy Grantham (Trades, Portfolio) with 0.28%.

Stanley Black and Decker

The investment fund reduced its position as Stanley Black-Decker Inc. (SWK) by 99.64%. The portfolio had an impact of -0.47%.

The company, which manufactures hand and electrical tools, has a market capitalization of $25.54 billion and a $31.55 billion business.

GuruFocus provides the company with a profitability and expansion score of 7 out of 10. The 8.94% equity yield and asset return of 3.66% exceeded 59% of companies in the commercial products industry. Its monetary strength has a rating of five out of 10. The debt ratio of 0.16 is lower than the industry median of 0.94.

The company’s shareholder is Barrow, Hanley, Mewhinney and Strauss with 2.52% of the shares outstanding, followed by Pioneer Investments (Trades, Portfolio) with 2.21% and Richard Pzena (Trades, Portfolio) with 1.66%.

Delta Airlines

The investment fund has left its stake in Delta Air Lines Inc. (DAL). The portfolio had an impact of -0.46%.

The company has a market capitalization of $17.62 billion and a $31.70 billion business.

GuruFocus provides the company with a profitability and expansion score of 7 out of 10. The 27.1four% equity decline and the asset decline of -5.52% are below 91% of corporations in the shipping sector. Its monetary strength has a rating of four out of 10. The debt index of 0.51 is higher than the industry median of 0.3.

The company’s largest shareholder is PRIMECAP Management (Trades, Portfolio) with 3.72% of the shares outstanding, followed by Pioneer Investments (Trades, Portfolio) with 0.06% and Stanley Druckenmiller (Trades, Portfolio) with 0.05%.

Disclosure: I own any of the above actions.

Read here:

Capital expansion leaves Philip Morris, Microsoft

CAMCO Investors cuts sony and American Express

Snow Capital leaves Facebook and Magellan

Not a GuruFocus Premium member? Sign up for a 7-day drop-off trial.

This article was first published on GuruFocus.