“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

(Bloomberg) – General Motors Co. he argued that he had a strategy to oppose his decline in China and pursue Tesla Inc.’s leadership in promoting electric cars in the world’s largest market.

The Detroit-based automaker on Wednesday defined its plan to implement new electric vehicles, fuel game, driving and connectivity application vehicles in China in virtual presentations through executives who added CEO Mary Barra and GM China President Julian Blissett.

GM is convincing investors that its global electric-style marketing strategy will make it a credible competitor to Tesla. GM also faces some voltage to turn its plug unit into a separate company after Wall Street has handed over billions of dollars to new electric vehicle companies in recent months.

“We are making a strong investment in generation and innovation that will help us achieve our vision,” Barra said in a video on the company’s investor website. “From 2020 to 2025, we will allocate more than $20 billion in capital and engineering resources to our electric and audiovisual vehicle programs.”

Barra’s presentation follows the unveiling of the Cadillac Lyriq SUV earlier this month and the launch of its Ultium vehicle battery in March.

While GM’s sales have shown resistance in China amid the coronavirus pandemic, long-term expansion customers have their new models, adding electric cars, to attract buyers. Demand for electric cars is accelerating and Tesla has temporarily taken the lead in Asia’s largest economy after starting production of its new multibillion-dollar plant in Shanghai.

The Chinese car market is recovering from a two-year drop, aided by the reopening of showrooms, the decline of the Covid-19 and the economy. Growth in electric vehicle sales overshadowed fuel consumers last month after a year-long government break in electric vehicle subsidies.

GM has announced plans to sell more than 20 models of electric vehicles until approximately 2023. The company’s battery can accommodate compact cars, pickup trucks and everything in between, GM President Mark Reuss said in the video.

“This is a great opportunity for us, the greatest opportunity we’ve ever noticed for this company,” Reuss said. “This represents a possibility to reinvent the corporate and reset our brands. This will replace this business and people’s perception.”

On Wednesday in Shanghai, GM gave more information about its new global electric vehicle platform, its Ultium battery formula and its next-generation electric vehicles for China.

Highlights include:

More than 40% of GM’s new releases in China over the next five years will be electrified models. They will be manufactured in China, with the maximum of all portions from local suppliers, GM will continue to implement and improve its Super Cruise driving assistance system, which will appear in the Cadillac line until the middle of the decade and extend to the Buick and Chevrolet Models. A luxury all-electric SUV will be available in China for thriving customers. It will have a glass ceiling and a more spacious interior thanks to a new battery architecture. By 2021, an advanced edition of Super Cruise will be available in China and the United States with features such as lane replacement on demand, as well as richer map data. GM will offer Super Cruise in 20 cars internationally until 2023 GM will also drive China’s progression of specific responses for intelligently connected cars, with its first global four-wheel drive program (V2X) to be introduced this year at the Buick GL8 pickup truck. GM cars in China will connect through flexible platforms; By 2022, the 5G will be available in all new Cadillac models and Chevrolet and Buick.La Ultium’s full battery cars can travel up to 400 miles with a battery-powered speed of 50 to two hundred kilowatt hours. The Tesla Model 3 features a long-range battery with 72.5 kWh of usable battery power.

“GM has an unprecedented scale to leverage great knowledge and use our wisdom to provide our consumers with higher quality, more cutting-edge and more knowledgeable services,” Blissett said. “In the near future, we will make connectivity a feature in almost all of our global branded cars introduced in China.”

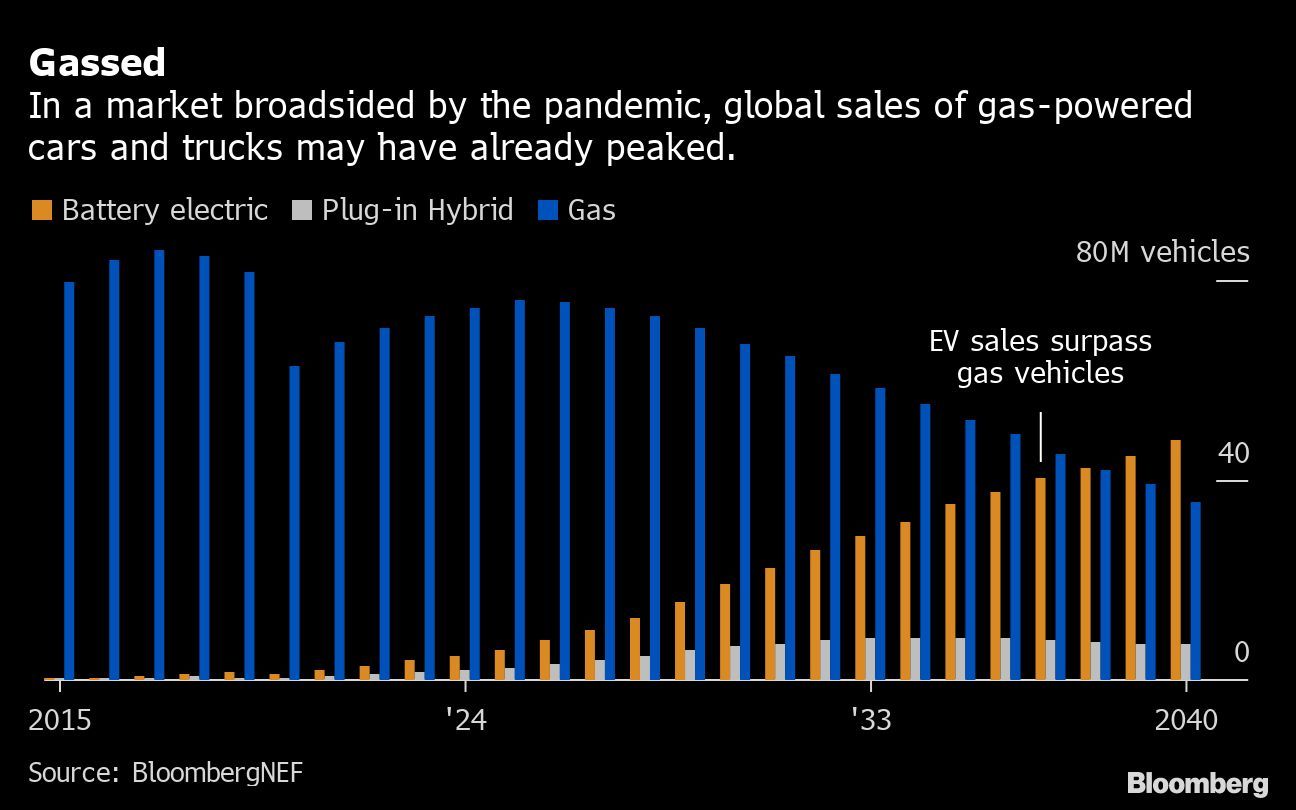

Gm’s core, selling cars and pickup trucks with gas game applications, generates cash, but it is noticeable to be in long-term decline and is less exciting for investors than the company’s electric car projects, Deutsche Bank AG analyst Emmanuel Rosner said in a note. Week.

While GM’s stock has fallen by about 18% this year, brands of battery-powered vehicles have reached new heights. Tesla’s stock has reached record levels, making the company the world’s most valuable automaker. Las startups Nikola Corp. and Workhorse Group Inc. also posted profits.

Meanwhile, Chinese electric vehicle manufacturers are accelerating their fundraising plans. Li Auto Inc. raised $1.1 billion at the end of July and Xpeng Motors is making plans for a $1 billion IPO. WM Motor Technology Co., meanwhile, is contemplating a percentage sale in Shanghai earlier this year, others close to the issue said, and Hozon New Energy Automobile Co. points to a directory in the same city next year.

(Add the Quote of Bar to the fourth paragraph and other main points along)

For more items like this, visit bloomberg.com.

Subscribe now to forward with the ultimate source of reliable business news.

© 2020 Bloomberg L.P.