jetcityimage/iStock Editorial Getty Images

Here’s something to look at about General Motors (NYSE:GM). Its diluted earnings consistent with constant percentage [EPS] have grown at a compound annual expansion rate [CAGR] of 68% over the past five years. However, its constant percentage value has increased by 4. 7% during this constant period. Even adding dividends, total returns increased by 12. 2% (see chart below).

Price and total profitability (Source: Searching Alfa)

Right off the bat, this indicates two facets of the action:

At first glance, this is a great position to start. Not only does this imply that the value of the company’s shares will increase, but so will its dividends. The question then is: will those gains be tangible for investors?

The company’s sales in the U. S. for 2023 are really encouraging. It continues to be the leading automaker, with a 0. 3 percentage point increase in market share to 16. 3%, while its sales increased to 14% for the year.

According to Marissa West, GM’s senior vice president and president of North America, industry sales are also expected to remain strong this year. This is encouraging given that there is a likelihood of a slowdown in its giant U. S. market this year and interest rates are expected. to stay high.

The figures also reduce the threat of earnings for GM in the fourth quarter (fourth quarter of 2023), the effects of which will be released later this month. This threat follows a strike that began on September 15 last year and continued into October, affecting a third of the last quarter.

The company lost around $800 million in operating profit as a result of this in the third quarter of 2023, resulting in a 7. 9% year-over-year contraction in the figure, rather than what would otherwise have been an increase. of 3. 1%. The source of income also decreased by 7. 3%.

With a longer strike era in the fourth quarter of 2023, analysts are now forecasting a significant drop in earnings per share of 47. 9% year-over-year (year-over-year) for the quarter, as a result of a contraction in 9. 5% gains. However, some comfort can be found in the fact that by 2023, earnings per share are expected to decline to 1% and earnings to increase by more than 7%.

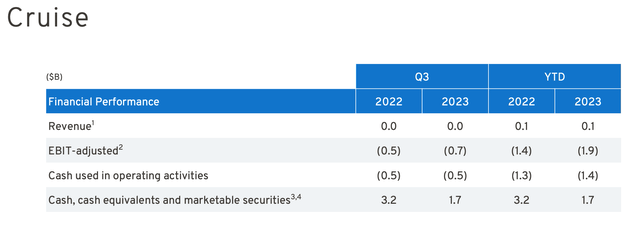

The company’s demanding situations related to its independent cruise business are also hard to ignore. The ride-sharing service introduced in San Francisco in early 2022 would also expand to other cities. But it didn’t, starting with static sales during the first nine months of 2023 compared to the same time in 2022 (see chart below).

Cruise, financial highlights (Source: General Motors)

But a twist of fate involving a pedestrian in October last year seriously cast doubt on the readiness of robotaxis. The company later recalled those cars and was banned by California authorities. GM subsequently withdrew its investments in Cruise, which, according to the Financial Times, amounts to about $700 million per quarter.

These developments also suggest that the company’s forecast of $80 billion in earnings for this company through 2030, or more than 55% of the company’s total profits in 2022, proves less likely. However, given that Cruise contributes slightly to GM’s earnings for now, that’s tomorrow’s problem.

Today’s problem is more the sentimental impact it could have had on the stock price, as yet another challenge for the company after it was already facing labour issues.

However, the company is making plans to increase its share price. At the end of November last year, it announced a $10 billion percentage buyback plan that is expected to be completed by the end of 2024. It also increased the split through 33%, which will increase payouts starting in 2024.

Today, the company’s dividend track record doesn’t inspire much confidence. Even leaving aside 2020, in which it especially reduced its dividends by up to 75%, and 2021, when it did not pay dividends, the truth is that they remained solid even from 2017 to 2019. Even today, the dividend yield on a GM investment made 10 years ago is less than 1% (see chart below), which is not much different from the TTM dividend yield of 1%.

Source: Alpha Research

However, the recent accumulation of dividends and the low payout ratio discussed in the first place imply that additional dividend innovations can be expected over time. This is especially true as its EPS is expected to begin to emerge this year.

Despite everything that went wrong at GM over the last year, I like it as inventory right now. In fact, it helps that it has fixed the problems of his hard work, at least for now. It also helps that he has more than just Cruise to keep him going.

The most recent sales figures show that its developing market share and optimism about this year’s expansion are also encouraging. Despite declining revenue in the third quarter of 2023 and an even bigger drop expected in the fourth quarter of 2023, full-year earnings may still be resilient.

Considering that this year is a year of expansion for GM, despite considerations about customer spending in the U. S. market, its dividends are likely to continue to rise. Its existing inventory multiples do indeed point to an increase in inventory. Question, I think there is a smart chance that investors could also make a profit in 2024. In fact, 2023 has proven that business can thrive even in challenging times. I’m leaving with a buy note from GM.

—

This article written by

Manika Premsingh is a macroeconomist who turns megatrends into actionable investment ideas. He has worked in investment management, stock brokerage, and investment banking. Manika was awarded the Goldman Sachs 10,000 Women Fellowship for a certification in commerce in recognition of her work as an entrepreneur while running her own study firm.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in GM over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Looking for Alpha Disclosure: The above functionality does not guarantee long-term results. No recommendation or recommendation is given as to whether an investment is suitable for a specific investor. The perspectives or reviews expressed above may not reflect those of Buscando Alfa as a whole. Seeking Alpha is not an inventory dealer, investment advisor, or authorized investment bank in the United States. Our analysts are third-party authors who collaborate with professional investors and individual investors who are licensed or qualified through any institute or regulatory body.