n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

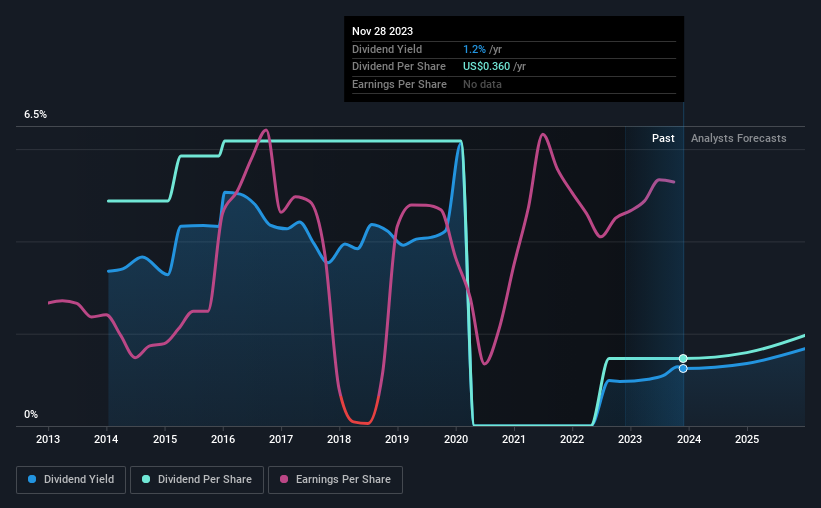

General Motors Company (NYSE: GM) will pay a dividend of $0. 09 on Dec. 14, meaning the annual payout will be 1. 2% of the existing percentage price, which is below the industry average.

See our latest analysis for General Motors

If they are predictable over an extended period, even low dividend yields can be attractive. However, prior to this announcement, General Motors’ dividend was comfortably covered by money and earnings. As a result, much of what he earned was reinvested. in business.

Looking ahead, earnings consistent with the percentage are expected to fall to as much as 2. 7% over the next year. If the dividend continues on the path it has followed recently, we estimate that the payout ratio could be only 4. 6%, which is comfortable for the corporate to continue in the future.

The company has a long history of dividends, but beyond the cuts it doesn’t look great. The dividend increased from an annual total of $1. 20 in 2013 to the recent maximum annual total payment of $0. 36. Dividend payouts fell sharply, by as much as 70% in this period. A dividend cut isn’t usually what we’re looking for, as it could mean that the company is facing some challenges.

With a volatile dividend and a history of declining dividends, it’s even more vital to see if EPS is rising. General Motors has noted that its EPS has grown over the past five years, up 56% annually. Rapid profit expansion and a low payout ratio recommend that this company has reinvested well in its business. If this continues, this company may have a bright future.

In summary, it is good to see that the dividend is staying consistent, and we don’t think there is any reason to suspect this might change over the medium term. The earnings easily cover the company’s distributions, and the company is generating plenty of cash. However, it is worth noting that the earnings are expected to fall over the next year, which may not change the long term outlook, but could affect the dividend payment in the next 12 months. All in all, this checks a lot of the boxes we look for when choosing an income stock.

Investors sometimes tend to favor companies with a consistent and solid dividend policy rather than those with an abnormal policy. However, investors want to consider a multitude of other factors, in addition to dividend payments, when analyzing a company. We’ve picked out two cautionary signs for General Motors that investors should be aware of before committing capital to this stock. If you’re a dividend investor, you may also want to check out our list of high-yielding dividend stocks.

Any comments on this article? Worried about the content?Contact us directly. You can also email the editorial team(at) Simplywallst. com. This article from Simply Wall St is general in nature. We provide observations based on old knowledge and analyst forecasts that employ only unbiased methods and our articles are not intended to constitute monetary advice. It is not advice for buying or selling stocks and does not take into account your purposes or monetary situation. Our purpose is to provide you with specific, long-term research based on basic knowledge. Please note that our research may not take into account the latest announcements from price-sensitive companies or qualitative factors. Simply put, Wall St does not have any position in any of the stocks mentioned.