n n n ‘. concat(e. i18n. t(“search. voice. recognition_retry”),’n

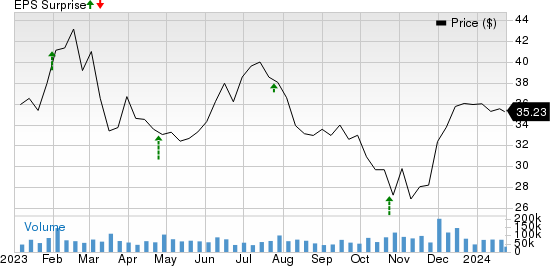

General Motors GM is expected to report fourth-quarter 2023 effects on Jan. 30, before the market opens. The Zacks consensus estimate for earnings and earnings for the quarter is pegged at $1. 09 consistent with a constant percentage and $43. 34 billion, respectively. The Zacks consensus estimate General Motors’ fourth-quarter earnings percentage has been revised up 3 cents over the past seven days. The final projection indicates a year-on-year decrease of 48. 58%. The general estimate suggests a year-over-year reduction. 6. 42%. In the recently reported peak quarter, GM beat earnings estimates thanks to better-than-expected earnings from GM North America (“GMNA”), GM International (“GMI”) and the GM Financial segments. Beyond For four quarters, the company has beaten the Zacks consensus estimate on every occasion, averaging 23. 82%. This is illustrated in the graphic below:

General Motors Company price-eps-surprise | General Motors Company Quote

General Motors’ U. S. sales in the fourth quarter rose 0. 3% year over year to 625,176 units. Sales of the Buick logo increased 57% year over year. Total Silverado sales increased to 143,390 units, compared to 141,912 units sold in the prior-year era, while overall Sierra sales increased 9. 8% year over year. Meanwhile, sales in the world’s largest auto market declined year over year. In China, General Motors sold 568,850 cars during the fourth quarter of 2023, down 1% year-on-year. The company saw a drop in sales under the Chevrolet (27. 44%), Buick (25. 91%) and Cadillac (4. 98%) logos, while sales of the Wuling and Baojun buildings increased by 8, 08% respectively. and 84. 81%. The segment is valued at $2. 66 billion, indicating a year-over-year decline of 8%. General Motors expects the loss of production resulting from the United Auto Workers strike (which began on September 15, 2023 and lasted six weeks) to have a significant effect in the fourth quarter, with an additional relief of $600 million in EBIT . . Our forecast for GMI segment operating profit (excluding the GM China joint venture) is set at $309. 7 million, up 13. 9% year over year. We expect operating margin to increase 0. 9% from the prior-year quarter to 7. 2%. Our sales estimate for the GM Financial unit is pegged at $3. 21 billion, suggesting a 7. 9% year-over-year increase. Our sales estimate for GM’s self-driving unit, Cruise, is $25 million, suggesting no replacement for last year’s quarter levels. Capitalizing on its $2 billion fee relief plan announced in early 2023, General Motors will reduce steady prices by another $1 billion over the period 2023 to 2024. The fee relief is expected to have an effect positive on GM Margins in the fourth quarter.

Our showcased style predicts consistent earnings with General Motors this season. The combination of a positive earnings ESP and a Zacks No. 1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of beating wins. This is the case here. Earnings ESP: It has a earnings ESP of 3. 47%. In fact, the maximum accurate estimate of $1. 12 per percent is 3 cents more than Zacks’ consensus estimate. You can see the most productive stocks to buy or sell before they’re flagged with our ESP earnings filter. Zacks Rank: General Motors lately has the second Zacks rank.

Here are a few other players from the auto space that, according to our model, also have the right combination of elements to post an earnings beat this time around.Lear Corporation LEA will release fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +1.36% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.The Zacks Consensus Estimate for Lear’s to-be-reported quarter’s earnings and revenues is pegged at $3.08 per share and $5.64 billion, respectively. LEA surpassed earnings estimates on each occasion, the average surprise being 9.10%.Ford Motor Company F will release fourth-quarter 2023 results on Feb 6. The company has an Earnings ESP of +4.93% and a Zacks Rank #3.The Zacks Consensus Estimate for Ford’s to-be-reported quarter’s earnings and revenues is pegged at 12 cents per share and $36.39 billion, respectively. F surpassed earnings estimates on two out of the trailing four quarters and missed twice, the average surprise being 20.30%.BorgWarner Inc. BWA will release fourth-quarter 2023 results on Feb 8. The company has an Earnings ESP of +2.44% and a Zacks Rank #3.The Zacks Consensus Estimate for BorgWarner’s to-be-reported quarter’s earnings and revenues is pegged at 91 cents per share and $3.59 billion, respectively. BWA surpassed earnings estimates on three out of the trailing four quarters and missed once, the average surprise being 10.93%.Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research?Today you can download the 7 stocks for the next 30 days. Click for this free report

Ford Motor Company (F): Free Stock Analysis Report

BorgWarner Inc. (BWA): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Lear Corporation (LEA): Free Stock Analysis Report

For this article in Zacks. com, click here.

Zacks Investment Research