Here at the Lab, our readers know that we follow the automotive and luxury sectors closely. Ferrari (NYSE:RACE) is an exclusive company that combines the two industries, and there are virtually no companies with this ability to allocate production to consumers with an order book that stretches through 2026. Our internal team has not commented on the company’s third-quarter results, but we offer a glimpse of the fourth quarter of 2023 combined with our forward-looking expectations for 2024.

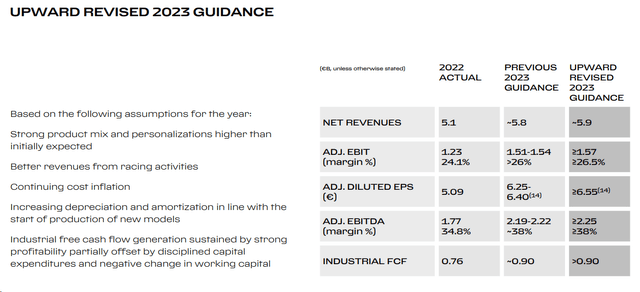

We have always appreciated Ferrari’s impressive execution, earning visibility and protection from macroeconomic factors supported by its audience of ultra-high-net-worth individuals. Following our last Ferrari analysis called Outlook Appears To Be Conservative, the company raised its 2023 outlook with approximately €100 million more adjusted EBITDA to arrive at €2.25 billion in 2023. Greater customizations supported this. In numbers, Ferrari achieved another remarkable Q3, beating estimates in every P&L line.

Ferrari’s monetary effects in the third quarter at a glance

Ferrari 2023 outlook

In hindsight, the company focused first on an adjusted operating profit margin of 26% in 2023. The EBIT margin was above 26. 5% at the beginning of November; However, this would mean a significant decrease in the last quarter. This decline in EBIT is unlikely to materialize in our estimates. However, sequentially, we estimate a slight contraction. This is based on several factors, including: 1) a weaker country mix with perfect numbers for the third quarter thanks to sales in the United States; 2) lower shipments (based on our estimates, we expect volumes to be solid compared to the fourth quarter of 2022), 3) higher depreciation charge (this includes the production of new models for cars such as the Ferrari SF90 and Roma Spider), and 4) higher study and development charge similar to F1 expenses (this charge is higher due to product development).

In a nutshell, our internal team is confident that Ferrari’s operating profit will likely reach €355 million with a margin of at least 23.5%. Last year, the company accurately forecasted its 2023 sales and earnings growth profile. As a reminder, Ferrari’s 2022 EBIT growth was supported by FX and volume, while the cumulative 2023 operating profit was backed by price & country MIX and personalization (these effects combined worth a total EBIT contribution of approximately €349 million). In 2023, volume was also a positive outlier, representing a growth of €58 million, much lower than in 2022, which positively impacted Ferrari by €261 million. On the downside, FX was a tailwind for €39 million this year. Our year-end estimates are €5.95 and €1.6 billion in sales and EBIT, respectively.

Looking ahead, the company expects a slight deterioration in the production of the MIX series. This is due to the decrease in the initial cost of Roma Spider (€249,650). Despite this, we are convinced that Purosangue’s sales will accelerate. Roma Spider and Purosangue were the only two cars that didn’t sell out completely. During the third-quarter analyst convention, the CEO explained how MIX will remain strong in 2024. While we may not possibly see an acceleration in 2023, the Ferrari-style push will likely lead to earnings growth. Then you have to consider at least 3 benefits:

The 2023 FX issue is expected to be less severe next year, and the company’s poor result in the 2023 F1 season will be offset by more races in the 2024 season (24 vs. 22 in 2023).

The company’s five-year plan, released in June 2022, envisages a core operating profit margin in the 27-30% range by 2026. We believe Ferrari is well on track to be on the target upper end. Overall, in 2024, we anticipate Ferrari will achieve €6.55 in sales and €1.90 billion in EBIT with a margin of 29.0%. This is supported by higher pricing (2%) and a better product MIX (+6.5%), despite the Roma Spider release. Our 35% dividend payout forecast implies a dividend per share of €2.35. This means a DPS increase of 30% compared to last year’s payment.

Two years of delays, advances in customization, and increased pricing activities bode well for 2024-2026. The discount granted to Hermès has been further extended, especially compared to October 2023; Meanwhile, the company has raised its outlook again. Here at the Lab, we were already above Wall Street’s estimates. We have not made any adjustments to our forecast estimates today. We expect the same old impulse to beat and revive for the company. We’ve kept our buy score at €350 percentage constant ($382 in ADR).

This article was written by

Analyst Disclosure: I hold/hold an advantageous long position in RACE shares, whether through stocks, securities, or other derivatives. I wrote this article myself and it expresses my own opinions. I don’t get any refunds for this (other than Looking for Alpha). I have no relationship with any company whose actions are discussed in this article.

Looking for Alpha Disclosure: The above functionality does not guarantee long-term results. No recommendation or recommendation is given as to whether an investment is suitable for a specific investor. The perspectives or reviews expressed above may not reflect those of Buscando Alfa as a whole. Seeking Alpha is not an inventory dealer, investment advisor, or authorized investment bank in the United States. Our analysts are third-party authors who collaborate with professional investors and individual investors who are licensed or qualified through any institute or regulatory body.