“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

(Bloomberg Review) – When Nikola Corp. listed on the Nasdaq in June, the Phoenix-based transportation company itself temporarily achieved a valuation of about $30 billion.

Its market price has since fallen to $10.5 billion more reasonable, however, it is still quite spiced for a company that has not yet generated revenue. Its most promising products are its heavyweights, powered by electric batteries or hydrogen fuel cells.

The rise of Nikola (whose name, bratly, is another evocation by electrical engineer Nikola Tesla) will have strengthened the view of European automotive industry leaders that the U.S. inventory market operates according to other rules. Although Tesla Inc. is only profitable, its price is around $275 billion, more than the five largest European automakers combined.

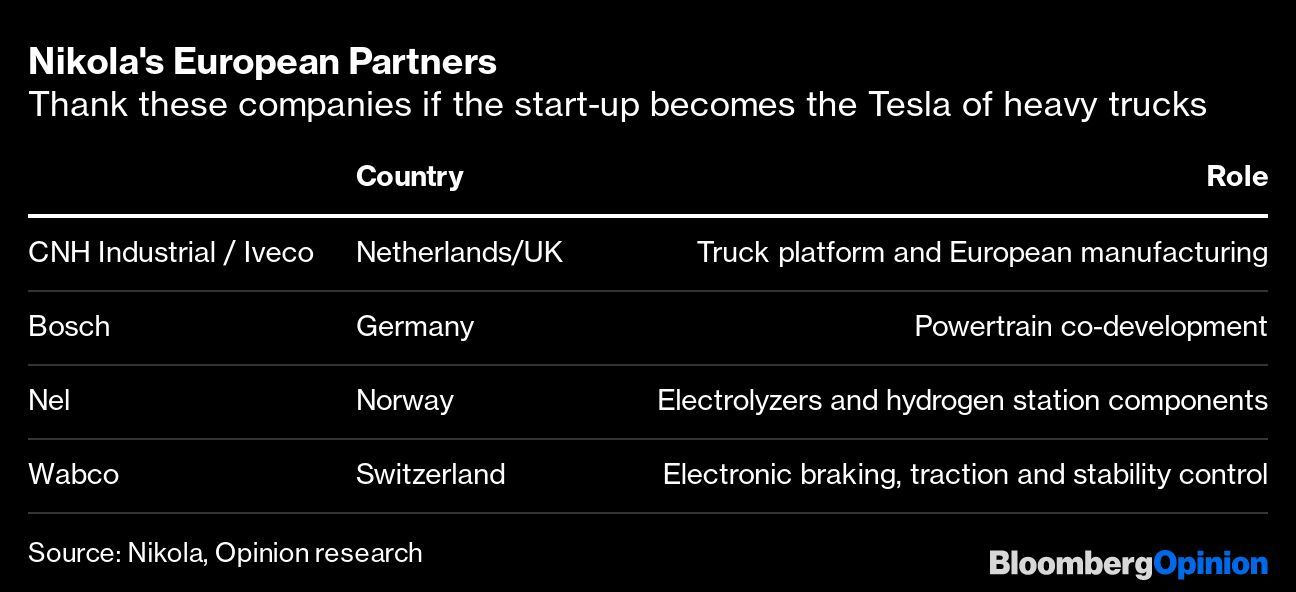

At least Europe has an interest in the latest high-profile project. Founded through Trevor Milton, a 38-year-old American defector, Nikola relies heavily on the experience of the old continent. Robert Bosch Gmbh, a German automotive equipment manufacturer, has contributed to the progression of the US company’s electric powertrain, and the first Nikola trucks will be built in a German factory owned by Italy’s Iveco, a truck manufacturer subsidized through the multimillion-dollar Agnelli family. Bosch and Iveco own more than 6% of Nikola. CNH Industrial NV, Iveco’s parent company, has just posted a fair price gain of $1.5 billion on this investment. (1)

The biggest question is whether a start-up dependent on as much outside aid has an impetuous valuation as tesla’s, which builds much of its own generation. And if Europe has that experience, why didn’t it produce its own rival for Elon Musk’s car manufacturer?

Maybe it’s a lack of bray. Nikola’s call isn’t the only explanation for why he’s compared to Tesla. Milton’s overactive presence on Twitter gives Musk a docile look in comparison. The two men’s ambitions go beyond selling zero-emission cars to produce and buy blank energy. While Nikola focuses on heavy trucks, he has promoted a variety of products to customers, adding a pickup truck called Badger. It’s cat grass for retail investors, as evidenced by musk’s Cybertruck excitement.

Although Tesla and Nikola paint in heavy electric trucks, they differ by at least two points. The first is hydrogen: Musk is derogatory, while Milton believes hydrogen is the best fuel for long truck trips. The moment is his attitude towards internal construction.

Certainly, in its early days, Tesla worked with Lotus to build the Roadster, and Daimler AG expanded the Model S sedan. Tesla partners with Panasonic to produce battery cells. But Musk stands out for looking to create his own technology, electric propulsion systems and automated driving software in car seats.

Nikola has developed his own software, information and entertainment system and battery control, as well as the aerodynamics of the vehicle, according to Cowen analyst Jeffrey Osborne. Subcontracted or used a hired assistant to do the most of the other things. More than 200 Bosch workers became concerned about the structure of vital parts of Nikola’s trucks, adding the electric axle motor, vehicle unit, battery and hydrogen fuel cell. The result is a sum of high-level assets held separately or jointly through Nikola and its suppliers.

However, there is no doubt who has the ultimate in-depth experience. So far, Nikola has received 11 U.S. patents, approximately 1% of The total Bosch is awarded in a typical year. “Bosch is paid to meet the industry’s product criteria,” Milton told me.

Getting partners to provide the basics of generation has some advantages. Nikola has only three hundred workers and yet his first trucks are expected to leave the production line soon. Working with partners reduces the threat of production delays and quality issues that have affected Tesla.

It is also an effective use of capital. Nikola’s study and progression expenses were just $68 million last year. Tesla spent $1.3 billion. After his IPO, Nikola has about $900 million in cash, this will not go very far in the automotive sector. For the North American market, Nikola plans to manage his own manufacturing, with the technical assistance of Iveco. Nikola opened a $600 million plant in Arizona this week.

Whether or not you believe that the broad involvement of external partners deserves your maximum evaluation, there are other things that may simply disappoint Nikola’s plans.

The structure of a refueling network is a central component of your business model, but it will not be reasonable at $17 million for each of the hydrogen stations. The company also enters a competitive building populated through more experienced rivals with greater capitalization. Daimler’s Mercedes-Benz did not stand firm in its early experiments with electric cars and let Tesla through. I probably wouldn’t make the same mistake with the trucks.

Daimler is the world’s largest truck manufacturer and plans to start production of its eActros and eCascadia electric models next year. The German giant has also formed a joint venture with Sweden’s Volvo AB to expand mobile hydrogen fuel systems for heavy vehicles. The company is valued through corporations at just 1.2 billion euros ($1.4 billion), which puts Nikola’s valuation in perspective.

Even if its percentage value is exaggerated, Nikola’s unlikely increase shows that there is a call from investors to blank transport corporations that do not yet have a foot in the beyond combustion engines. European brands have the technical skills, but they want to find better tactics to capitalize on investor enthusiasm through new business models or spin-offs. Otherwise, it will.

(1) Measured on June 30, when Nikola’s inventory was much higher

This column necessarily reflects the perspectives of the editorial board or Bloomberg LP and its owners.

Chris Bryant is a Bloomberg opinion columnist covering commercial companies. He’s been working for the Financial Times in the past.

For more items like this, visit bloomberg.com/opinion

Subscribe now to forward with the ultimate source of reliable business news.

© 2020 Bloomberg L.P.