eMagin is an American OLED microscreen.

The corporate has exclusive generation in microscreens and direct pattern remedy that has caught the attention of the U.S. Department of Defense.

As a result, the company won Department of Defense awards for more than $39 million.This budget will be used to increase production capacity.

The Department of Defense budget also helps the corporate extra to penetrate customer and advertising markets in augmented and virtual truth (AR / VR).

eMagin is an ACHAT.

eMagin (EMAN) manufactures microscreens based on biological light-emitting diodes (“OLED”) for use in computers and state-of-the-art imaging devices.For more than 3 months, eMagin has won Ministry of Defense (“DoD”) awards totaling $39.1 million (see here and here). In addition, the company recently announced in the convening of the convention at the time of the quarter that it had received two new patents, a similar one to demonstrate generation (see US patent).Hus No.10741129) and the other similar to the company’s direct pattern demonstration generation (“dPd”) (see US patent).U.S. number 10644239). The CEO, Andrew Sculley, said the call:

This morning, we also published a press on two other patents for our Direct Patterning that relate to the strategies and manufacture of OLED microscreens These two new patents add up to the 16 existing foundational patents we have already received for our dPd technology. And there’s more to come.

The two recently issued patents and the DoD Awards seem to validate the company’s cutting-edge generation for its military products, but in my opinion the largest investment thesis is that EMAN deserves to be able to reduce costs and a counterfeit patent portfolio.expand two potentially much larger companies:

The investment provided through these awards will allow us to obtain key gadgets and tools, adding dPd appliances, and lately we are defining specifications and planning to place orders for new appliances in the coming weeks.Our first shipments of devices under this three-year program would take up position at the time of the 2021 quarter.

Then I’m going to get through to government funding.What this does for us is for unique blackouts.So you’ve heard in the afterlife that we haven’t had that.We’ve been very smart at keeping that now. But if your tool breaks, and it’s a single tool on a production line, we want to take care of it and fix it, so we’re building a small inventory.

The company also said in the press release at the time that it won a $1.96 million PPP loan at the time of the quarter, which allowed it to complete the job and that it said it would be canceled.

Source: Q2 10-Q SEC Filing

As can be seen in the chart above, the second quarter profit of $7.7 million 44% year-on-year, 15% sequential, and surpassed the company’s most sensitive previous forecast.

Our R

For the six months ended June 30, 2020, the REM incurred a net loss of $4.2 million and used $0.2 million of money for operating activities.As of June 30, 2020, the Company had $5.4 million in money, $0.4 million in remarkable debt and $3.1 million in loan availability for its asset line of credit.Financially, the company is fine.

The number of shares is something to consider.On 10-Q reported that as of July 31, 2020, 67,381,256 non-unusual actions were notable.This is an 18% increase in the weighted average number of notable shares reported in the time quarter report.

In addition, 10-Q warned of dilution due to the following:

Source: SEC Deposit 10-Q T2

In the worst case, if all these shares are put on the market, this would dilute 58.6% of the 67,381,256 shares issued at the end of the quarter and would bring the number of notable shares to 95,250,722 shares.

10-Q says the company has a general authorization of 200,000,000 shares and just over a hundred employees.

Note that the bullish effects of the second quarter continued its momentum after a report of the first falsified quarter:

We continue to see a strong demand for finishes for our microscreens.In the ultimate military market, we supported the ENVG-B program, which resulted in successful prototypes for major contractors.As a result, we are recently for new production orders.delivered from the end of 2020 to 2021.

In addition, we are in conversations with a number of Tier 1 corporations, some of which we know very well, who want brilliant OLED microscreens for their AR/VR work, two of those discussions have taken a stand with corporations with which they already exist. Agreements.

This also bodes well for the expansion of new orders. The company’s screens are also found in firefighting/law enforcement thermal systems, veterinary ultrasound goggles, cataract operating systems and magnetic resonance and LASIK systems on the medical market, all of which have long offered.run the forward-looking expansion (see slide 7).

At the time of the quarter’s call, Sculley also stated that EMAN had made significant progress in our processes and returns, with the on-time delivery of visitor orders that remained at more than 95% for the first part of 2020 and also stated:

We also have more innovations expected at a time that we believe will have a primary effect on results. As volume increases, we continue to advance our dPd and R efforts.

These settings have a fairly dramatic effect on the margins.According to CFO Mark Koch, the second quarter call:

Currently 26% gross margin on gross profit of $ 2 million compared to 4% gross margin and $ 0.2 million gross margin for last year. Improvement in gross margin is the result of favorable margins on contract earnings for the customer market and advanced product margins Gross margin for the 2020 quarter of 2020 compares favorably to 1% last year, which was impacted through a minimization in performance due to production disorders that have continued since the first quarter of 2019.

And, as is sometimes the case with this kind of new technology, EMAN’s well-established presence in the military and the aeronautical market allows it to leverage its platform to expand major expansion opportunities in RA/VR customers and advertising markets, analogous to semiconductor corporations.publish the Apollo program to take a man to the moon (miniaturization, low power consumption, long battery life, wide temperature range, etc.).However, a long-term key will be the company’s ability to expand marriage relationships and allow higher production to meet the massive market of customers and businesses.This was highlighted in an earlier article through Seeking Alpha through collaborator Brendan Rose (eMagin: Nothing is more than getting a production spouse through volume).Now that EMAN has two more dPd patents, you can simply boost your search for a giant production spouse.

Many industry mavens that OLEDs are about to upgrade existing technologies in the demo ecosystem. As such, a significant number of corporations have started to invest more and more in OLED-related studies and progression activities.

The combination of this type of expansion in the microscreen market and the fact that the experts that OLEDs are probably to update existing screens is a great opportunity for eMagin.

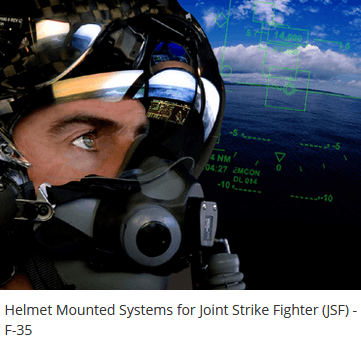

As a young engineer in California years ago, I can attest to the army’s obsession with generating net demonstrations.Whether it’s a radar screen or a flight screen, the military knows the importance of generating smart demonstrations.Very long hours, in difficult situations, can suffer visual fatigue, fatigue and even nausea due to poor demonstration generation The large DoD contracts with EMAN seem to validate the company’s cutting-edge generation.-Screens are expected to quintupte to $1.3 billion through 2024 (see slide at the end of the article). This is a massive tailwind for eMagin, given all indications, it turns out that the generation of DoD selection microscreens has evolved.

Source: Google Earth

Consumers and investors have been talking about augmented truth and virtual truth for years.RA greatly expands the tactics in which our devices can help you with activities such as buying a home, searching for data and self-expression.it’s like moving anywhere from a lunar land vehicle to Hoover Dam, the front row of a concert or remote planets in space.

This generation of microscreens will meet the order of a variety of proximity displays and other portable devices and that the global microscreen market will succeed in 50 million devices by 2024.This includes AR/VR systems, smart glasses, helmet frames.(HMD) and head-up presentations (“HUDS”) – virtually all programs that require maximum resolution.

Conclusion: eMagin has the right chance to participate in those new AR/VR markets, markets that are just beginning to give an idea of their expansion potential.In particular, Apple’s obsession with amazing quality will likely lead them to call door for its market-leading dPd microscreen technology.

The control team consists of highly trained and experienced technical experts:

As an electrical engineer, it’s great to see such an experienced and professional team in virtually every key senior control position.

Thanks to the technical control team, it is not surprising that EMAN has a strong patent portfolio: 42 granted; 40 p Finishing (see slide 14) . The main patents cover ultra-high brightness (10,000 CD/m2 at the end of the year and 28,000 CD/m2 until 2023) and stamped OLED screens and, as explained earlier in the article, eMagin has a strategic merit in OLED microscreens with direct RGB soft emission of color and without the need for color filters.

In fact, the company announced on August 13, 2020 that it had received two new patents for its generation of Direct Patterning Display (“dPd”).The press release states that the new patents are in addition to the existing eMagin portfolio of 16 basic patents and application programs for dPd generation that generation EMAN in OLED modeling, processes and equipment.

The dPd generation of eMagin has the potential to succeed over the proven limitations in the VR/AR market, which IDC says will succeed in more than one hundred million sets by 2023.

It seems that the dPd generation can change the rules of the game in the OLED market.

In the call of the quarter convention, Sculley said:

Finally, our dPd generation is limited to undeniable microscreens, being able to be implemented more widely or authorized to other OLED screen brands for sizes that go beyond microscreens.

Licensing the company’s patented generation can open a new source of profit for the company.Sculley discussed this in the last quarter’s call:

There is – when we think of higher volume, like customer market, the tool that we have lately, this R tool

Sculley also said the generation could extend to larger screens, for watches and cell phones.

eMagin remains a successful company.

eMagin accomplished a forged T2 in spite of the demanding situations of COVID-19.The corporate remained open because of its prestige as an a must-have corporate for the defence industry.COVID-19 will continue to pose doubtful dangers to eMagin and its source chain and consumers for the foreseeable future.

The number one threat facing EMAN is the environment of the macro market site in which valuations of generation stocks have skyrocketed.EMAN would not be saved from a significant correction of the market site.That said, as a very low-priced stock, EMAN could fall less than the market.marketplaceplace as a whole. After all, the existing patent portfolio and Department of Defense contracts provide a smart floor.

According to SEC 10-Q’s most recent presentation this quarter, EMAN is purchasing all of its silicon wafers, a key element in its OLED production process, from two suppliers in Taiwan and Korea.EMAN would suffer particularly due to serious interruptions in the source of silicon wafers.That said, the corporation stated that it had a stock of wafers at hand for such an interruption.