“o. itemList. length” “this. config. text. ariaShown”

“This. config. text. ariaFermé”

– By Sydnee Gatewood

The Corporate Dodge Investment

Founded in 1930, the San Francisco-based investment company brings a classic technique to long-term value, avoiding popular corporations engaged in the industry at maximum prices. Instead, it conducts in-depth studies on corporations with low valuations and promising earnings and prospects for monetary expansion. .

Warning! GuruFocus detected nine precautionary symptoms with MAT. Click here to exit.

15-year MAT monetary data

The intrinsic thing about MAT

Peter Lynch’s portrait through MAT

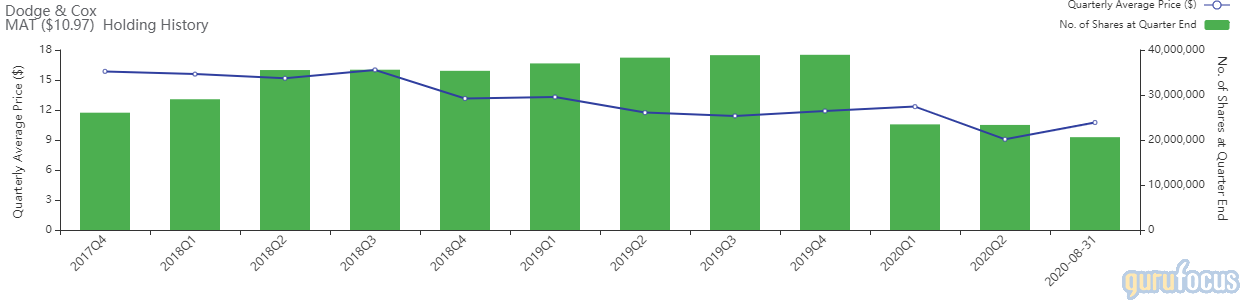

According to GuruFocus Real-Time Picks, a Premium feature, the company sold 2. 7 million according to the percentages of the company based in El Segundo, California, on August 31, which had an effect of -0. 03% on the equity portfolio. trading at an average value of $10. 75 consistent with the consistent percentage on the day of the transaction.

Dodge

The toy company, for iconic brands such as Barbie, Fisher-Price, Hot Wheels and American Girl, has a market capitalization of $3. 81 billion; its shares traded around $10. 97 on Thursday with a price/pound ratio of 44. 23 and a price/sale ratio of 0. 89.

The average selling price chart shows that inventory is quoted below its old average, suggesting that it is undervalued. in 10 years.

On July 23, the company released its quarterly monetary results of the time. With an adjusted loss of 26 cents consistent with a consistent percentage of $732 million in revenue, Mattel exceeded Refinitiv’s estimate of a 34-cent loss consistent with a consistent percentage of about $679 million in revenue. Net toy sales declined by 15% year on year.

In a statement, executive chairman Ynon Kreiz praised the company’s functionality in the face of closures of stores similar to the Cov-19 pandemic, which “demonstrates our execution functions and the strength of our brands. “

“While revenues dropped, they exceeded our expectations, especially in North America, Barbie and Games, where we saw higher sales,” he said. grow strongly in all regions. “

GuruFocus rated Mattel’s monetary strength at 3 out of 10 due to the issuance of approximately $583. 9 million of new long-term debt over the more than 3 years, the company has low interest coverage. The reversal of the investment is also overshadowed by the weighted average capital burden, indicating that the toy manufacturer destroys the price because its projects yield less than the prices to finance them.

The profitability of the company is consistent with better formed, achieving a score of 6 out of 10, despite margins and lower returns than part of its competitors. Mattel is also supported through a moderate Piotroski F Score of 5, suggesting that the partyists with the conversations are stable. However, the predictability score of 3. 5 out of five is monitored due to the record of inconsistent profit loss with a steady profit and the decrease in cash in line with the percentage consistent in recent years. GuruFocus’s knowledge shows that corporations in this range generally return, on average, 9. 3% consistent with the year over a 10-year period consistent with the period.

Among the gurus invested in Mattel, PRIMECAP Management (Trades, Portfolio) has the largest stake with 14. 05% of the shares outstanding: Mason Hawkins (trades, portfolio), John Rogers (trades, portfolio), T Rowe Price Equity Income Fund (trades, portfolio), Lee Ainslie (trades, portfolio), Joel Greenblatt (trades, portfolio) and Mario Gabelli (trades, portfolio) have positions in the stock.

Portfolio composition and performance

Dodge’s $108. 73 billion portfolio

Another recreational name maintained through the company as of June 30 was Booking Holdings Inc. (NASDAQ: BKNG).

Dodge

Disclosure: No charge.

Read here:

Tiffany shares lose their brilliance when LVMH closes $16. 2 billion deal

Stanley Druckenmiller says the market is in an ‘absolute rage mania’

Warren Buffett continues to make money at Wells Fargo

Not a GuruFocus Premium member? Sign up for a 7-day drop-off trial.

This article was first published on GuruFocus.