Pictures of Mark Renders/Getty

It has been a full year since CNH Industrial N. V. (NYSE: CNHI) spun off Iveco Group N. V. (OTCPK: IVCGF), separating its off-road and off-road devices business.

A year ago, my thesis was that CNH Industrial had become a large corporation, divesting itself of low-margin businesses, while retaining and focusing on higher-margin ones. As a result, I have been a shareholder of CNHI this year. On the other hand, the more I looked at Iveco, the more I saw an attractive company, but too weak to be globally competitive: margins were slightly positive and the only market where the company is strong is Europe. That’s why I thought of him as a candidate most likely to be acquired through a larger competitor.

Both corporations reported annual results. It’s time to see if the price is unlocked for any of them and what investors deserve to expect from them.

In 2022, I wrote several times that I saw CNH Industrial N. V. as very favorable. compared to its major Western peers, Deere and AGCO.

My main argument, besides the derived benefit, is quite simple. The company had retained the more successful business of the two. In addition, in a year when demand for tractors and combines skyrocketed impressively, I warned that we would see that the market leader would not be able to meet and fulfill all incoming orders. As a result, part of the demand for premium tractors would be transferred to the largest player at the moment in the sector, namely CNH Industrial. I believe this environment would also have put pressure on Deere’s margins initially, while helping CNH Industrial increase its margins.

Now that a year has passed, we can see that things have turned out according to this forecast. Deere’s margins struggled in the early part of 2022, only to recover in part thanks to large increases in value. CNH Industrial continued to have higher margins quarter over quarter.

If we raise some macro trends that act as significant tailwinds for agricultural appliance manufacturers, there were several compelling reasons to consider investing in CNH Industrial. It seemed that investors had taken note of this from last year until now. , when CNH Industrial really delivered a little more than Deere. This is a rather peculiar situation, as CNH Industrial, so far, has lagged behind its larger counterpart.

Data via YCharts

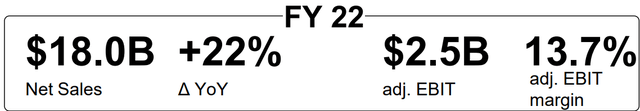

CNH Industrial recently published its annual report. Here we can see a brief summary of the main highlights of the department of agriculture that I should keep in mind. At the moment, agriculture accounts for more than 83% of total sales and, within the structure department, is also the one that increases the most. The profitability of the company.

Presentation of the effects of CNHI Q4 2022

We see agricultural earnings increase by 22% and reach an adjusted EBIT margin of 13. 7%. In the fourth quarter, this margin was 13. 1% compared to 14. 7% in the previous quarter. However, the company obviously achieved its purpose of increasing profitability, aiming to close the hole with Deere’s impressive >20% margins.

As can be seen from the tables below, both agriculture and structure have progressed and behaved well. However, the structure is a department that lacks small scale and is not yet profitable, agriculture presenting the figures of a well-established activity.

Presentation of the effects of the CNHI Q4 2022

Overall, the off-road business, which remained under the call of CNH Industrial, had the possibility to better demonstrate its profitability and a more advanced monetary position. During the last earnings call, Scott Wine, CEO of CNH Industrial, spoke about the advance of the monetary position, highlighting how it plays a key role in reviewing capital allocation priorities:

In the first year of the spin-off, we were able to increase our net monetary position through $1500 million thanks to the money generated through operations. This brings us to our capital allocation priorities. And our goal is to spend $4400 million through the combination of R

CNHI has announced its separation from Euronext Milano to have a singles board on the New York Stock Exchange until early 2024. This will help investors understand the company as a global player. In addition, I think we can expect the company to take steps to attract more investors. For example, I think CNH Industrial is very likely to pay its dividend quarterly after getting its exclusive directory on the NYSE. By the way, CNH Industrial also just announced a 29% dividend building for this year.

Over the past year, I have rated CNH Industrial as a purchase. With the recent increase in value and a market capitalization close to $23 billion, we are approaching my goal of a market cap of $26 billion, leaving an increase of just over 10%. While this may still be an access point to initiating a position, I will not increase my stake in CNH Industrial N. V. At the moment, considering that the inventory is too close to its fair value. That’s why readers will see me compare CNH Industrial as a constraint right now.

I started covering Iveco when I talked about the 3 recent European side effects on trucks. In my first article on Iveco, I explained how the company, which had some strengths, had a slight success with a negative loose cash flow. Compared to other truck manufacturers, Iveco seemed to me to be too focused on Europe and with low profitability, due to its low single-digit margins. That’s why I advised promoting inventory and staying away. Now Iveco has published its annual effects and we have some vital updates.

First, let’s take a look at some monetary highlights:

Presentation of results Iveco Q4 2022

Revenue increased by 13. 1% to €14. 2 billion. The EBIT margin is also positive, reaching 3. 7%. This figure alone shows that Iveco still has a long way to go, given that the main players in its sector – Volvo Group and Paccar – already exceed 10% and that, among the latest spin-offs, Daimler Truck is doing better and is on the verge of achieving double-digit margins in just a few years.

The good news is that Iveco continues to record a positive trade loose cash flow, as its net trading monetary position has increased significantly.

On the other hand, Iveco remains too dependent on Europe, whose dubious geopolitical scenario is well known. Unlike CNH Industrial, whose business in the Americas is successful and relevant, Iveco still has a long way to go to gain market share. Outdoor its main market.

Presentation of results Iveco Q4 2022

In addition, the company relies heavily on trucks (58% of revenue), where the festival is more difficult.

So, at the end of the first year, I must admit that Iveco has taken some steps in the right direction. However, its profitability has increased a bit, it still turns out to me to be the weakest pair in its industry, and I still think we can see it bought through one of the biggest players.

Compared to last year, I have d my score Iveco Group N. V. to sell to keep. An EV/EBITDA just above 5, I think, is a fair relationship for a company like Iveco Group N. V. , which will have many parameters before being considered a true global player.

Iveco also partnered with Nikola (NKLA) to build all-electric cars. However, to keep this article at a moderate length, I plan to publish this message in the coming weeks to help each and every reader understand how I see it and what I expect from it.

Editor’s Email: This article discusses one or more securities that are traded on a major U. S. stock exchange. U. S. Be aware of the dangers associated with those actions.

This article written by

Disclosure: I have/have a long advantageous position in the shares of CNHI, DE, whether through ownership of shares, features or other derivatives. I wrote this article myself and it expresses my own opinions. I don’t get any refunds for this (other than Seeking Alpha). I have nothing to do with a company whose actions are analyzed in this article.