“R.itemList.length” “- this.config.text.ariaShown

“This.config.text.ariaFermé”

Global Automotive wakes up at dawn in the era of green steel

Electric vehicle sales expansion elections to live up to unprecedented demand for nickel and cobalt

Preliminary effects verify long-term, low-cost, development-ready assets

MELBOURNE, Australia, 27 August 2020 (GLOBE NEWSWIRE) – Co-Chairman Robert Friedland and CEO Sam Riggall of Clean TeQ Holdings Limited (Clean TeQ or company) (ASX/TSX: CLQ; OTCQX: CTEQF) supply the after the Sunrise Nickel-Cobalt-Scandium project update.

ELECTRIC VEHICLE MARKET UPDATE

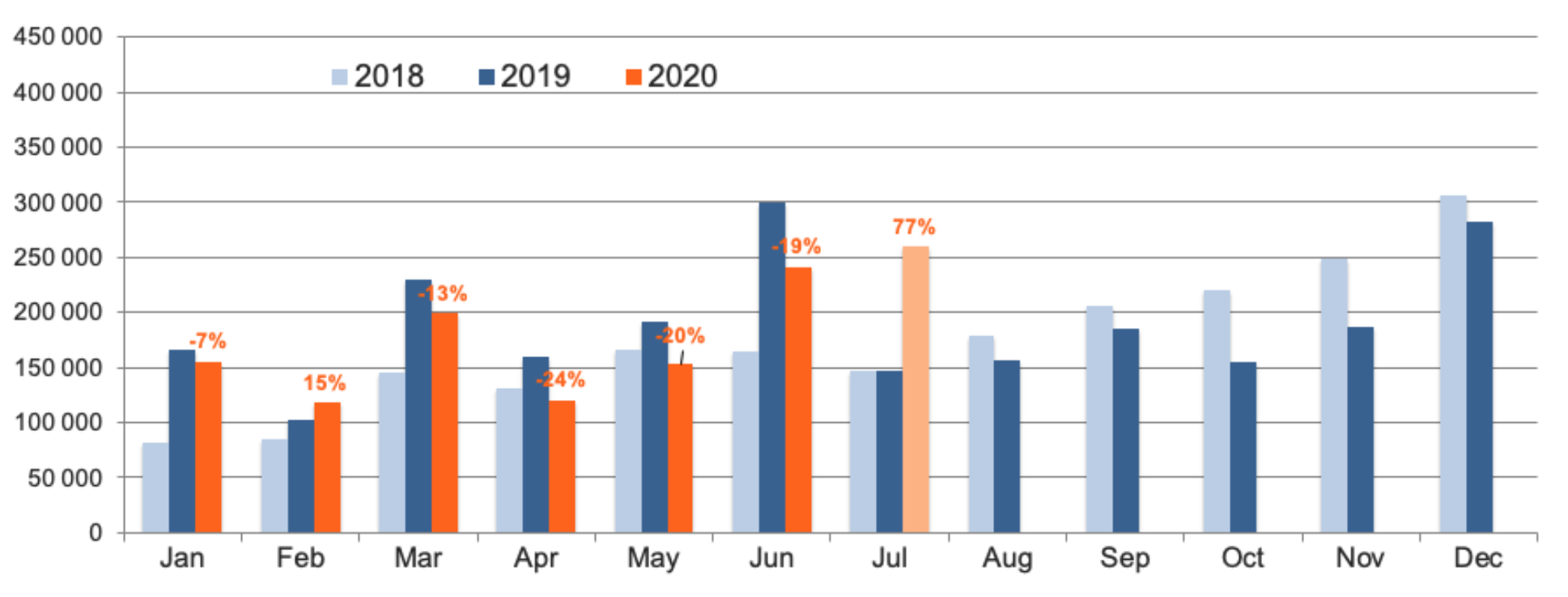

Despite the economic uncertainty created through COVID-19, global sales of electric cars increased in June and July and once returned to a healthy expansion trajectory, backed by government policy projects around the world.

To offset the fall in sales of electric vehicles in China in the first part of 2020, European sales were strangely strong as automakers are preparing to introduce a number of new electric models to the market. For the first time, Europe surpassed China as the world’s largest market, with more than half a million plug-in electric cars sold in the first part of 2020. Governments across Europe are introducing stimulus packages that will drive the adoption of electric cars. in the process. COVID-19, backed by a combination of stricter emissions criteria and subsidies to stimulate customer demand.

These projects are expected to lead to a strong recovery in 2021. Benchmark Minerals, an industry-leading forecaster for the battery fabric industry predicts that global battery demand will succeed at approximately 800 GWh through 2025 (166 GWh by 2020), with a CAGR of 37%, requiring nickel intake in batteries to increase from 140kt by 2020 to 570 kt by 2025.

You can get a photo that accompanies this ad in https://www.globenewswire.com/NewsRoom/AttachmentNg/335fe425-b8e8-4258-a371-d6258b841780

In response, we have noticed that automakers actively restructure their operations and chains of origin to adapt to the new truth of electrification. Automotive corporations are investing in safe battery capacity and production capacity (e.g. Volkswagen’s acquisition of a 26.5% stake in Chinese battery manufacturer Guoxuan High-Tech Co Ltd). Similarly, OEMs, such as Tesla and BMW, directly hire mining corporations to unload raw fabrics from low-risk jurisdictions that meet minimum morality and sustainability criteria. The transparent trend is greater integration of the source chain.

In the origin aspect of raw materials, COVID-19 has postponed and delayed several China-funded nickel advances in Indonesia due to a combination of structural labor restrictions and, in some cases, network opposition. Outaspect Indonesia, hardly new nickel capacity is being developed. While cobalt markets remain well balanced, the Mutanda mine in the Democratic Republic of the Congo, which accounts for 20% of global capacity, remains in monitoring and maintenance due to low cobalt prices, while consumers actively seek characteristics of origin outside the Democratic Republic of the Congo.

“We’re sitting at the foot of a massive wave that’s growing,” Friedland said. “The transition to a cleaner and more effective energy bureaucracy is inexorable. That was the case. What is rarely understood is the profound effect of these transitions on source chains and raw materials. In the renewable energy box, the mining industry has not yet understood the scale of the challenge it faces and, at least for now, does not perceive the strategic importance of assets, such as Sunrise, which are essential to enable these new energy technologies.

“Sunrise is a style to build the long-term mine for emerging, technology-driven markets. If a company like Tesla can obviously make its considerations – “please extract more eco-friendly nickel” – now it is up to the mining industry to provide a solution”.

RESULTS OF SUNRISE’S INTERMEDIATE STUDY

As noted in the past, the company will publish the final effects of its Project Implementation Plan (PEP) by the end of September 2020, adding a full economic assessment of the project. It will incorporate the latest engineering and design paints based on updated curtain quantities, supplier costs, and labor costs.

Despite the accounting deterioration, the Company remains incredibly confident that Sunrise is an exceptionally exclusive and strategic asset whose intrinsic price is not in the price of its e-book, but in its large-scale and long-term resource, low cost of production and its advantageous sustainability references to other possible supply resources.

When the final effects of the PIP are announced by the end of September 2020, the Company will base the Project’s economic research on assumptions consistent with market conventions and steel value forecasts through an external indefinite expert. These value forecasts will reflect the values needed to inspire new projects to meet expected demand. It should be noted that indefinite long-term value forecasts for nickel and cobalt have sometimes been strengthened over the following year due to challenging source prospects, increased confidence in the adoption of electric cars, and a growing awareness of source risks.

The main economic assumptions to be followed in the monetary assessment of the allocation will be:

Discount (actual 2020)

8%

Long-term nickel sulfate value (USD/t NiSO4)

$5,300

Long-term nickel steel value (USD/t Ni)

$21,900

Long-term cobalt sulfate value (USD / t CoSO4)

$12,200

LME Long-Term Cobalt Value (USD/t Co)

$59,500

Price of scandium oxide (USD / kg)

$1,500

AUD/USD Rate

0,70

Note: The values shown are in genuine 2020 terms. The value of LME nickel steel excludes a ni sulfate premium of $1/lb. It represents a steel content of 22% in NiSO4 and a cobalt steel of 20.5% in CoSO4.

Based on these economic assumptions, the monetary effects of PEP are expected to be very strong, positioning Sunrise’s assets as one of the world’s cheapest nickel and cobalt producers.

Below are the most productive existing allocation estimates of the first 25 years of the mine’s life, which shaped the basis of the impairment test. Note that PIP deliverables are not yet complete and that these estimated effects may be subject to significant adjustments when the final effects are published by the end of September 2020.

Cost of capital

The current estimate of the pre-production asset progression fee is approximately US$1.990 million, adding contingencies. This represents an accumulation of approximately one-third from the 2018 DFS estimate, due to a number of factors:

Changes in the scope of engineering and design to reduce plant and infrastructure hazards, and to ensure it is a success.

Variations of building materials, designs to facilitate access for plant maintenance and increased redundancy of appliances in the interfaces of primary procedures.

Updated the refinery design to allow refining of primary, intermediate and secondary (recycled) metals.

Construction of a longer power line from the Centro Regional Parkes to the site. Connecting to the New South Wales power network in Parkes is a vital catalyst for providing functions for a 100 percent renewable force.

Increasing oblique costs, time-dependent assumptions such as labor and productivity rates, structure method, and labor requirements.

Sunrise’s existing capital intensity estimate was publicly compared for data with the structural charge and actual production capacity of several nickel/cobalt plants of similar scale in Australia, the Philippines, Cuba and Papua New Guinea. While Sunrise’s capital intensity, at US$56K/t equivalent of Ni, is at the top end of this comparable range, it is worth noting that the allocation incorporates a number of safety, environmental and operability design features that particularly differentiate it from other goods. Industry.

Production

Existing estimates of extraction, processing, production and sales forecasts are:

Physical

Annual average 2 to years

Annual years 2 to 25

Extracted ore (tonnes) 1

5 531 402

3325 140

Ore plant energy (tonnes) 2

2 572 146

2 655 361

Nickel shade: plant energy

0,91%

0,77%

Cobalt quality: plant supply

0,19%

0,13%

PAL feed mineral (tonnes)

2 472 566

2 488 875

Nickel quality: PAL supply

0,93%

0,80%

Cobalt quality: PAL feed

0,19%

0,14%

Nickel recovery: PAL supply

92,50%

92,35%

Cobalt recovery: PAL supply

91,09%

90,88%

Production and sale

Annual average 2 to years

Annual years 2 to 25

Nickel sulfate (tonnes)

96 753

83 596

Cobalt sulfate (tonnes)

20 916

15 245

Metallic nickel (tonnes)

21 286

18 391

Cobalt steel content (tonnes)

4 351

3 171

Sc-shaped Scandium (OH) 3 (Kg) 3

25 098

Scandium oxide (Kg) 4

9 600

15 667

Ammonium sulfate (tonnes)

60 306

50 462

1 The optimized mine plan arrives at the intermediate tissue garage in the early years for processing in later years.

2 The ore is enriched with sterile silica before being inserted into the autoclave.

3 Scandium is recovered as a by-product of nickel and cobalt production, first in the form of scandium hydroxide concentrate that is stored in place until it is required for conversion into scandium oxide. The figures cited are equivalent to scandium oxide (Sc2O3).

4 In-place scandio hydroxide is subtle and sold to order. The corporation assumed that sales of scandium oxide would increase from 2 tonnes consistent with the year in the third year to 20 tonnes consistent with the year in the tenth year.

Operating costs

Sunrise is designed to get some of the cheapest steel assemblies in the global battery chain. Backed by built-in mining/refining and strong credits through the product, Sunrise points to the first quartile’s nickel production prices over its 40-year lifespan.

Existing estimates of the operational costs of the allocation, which are subject to continuous review until the final touch of the PIP phase, are:

Production and sale

US $ / lb Ni Years 2 to 11

US $ / lb or Years 2 to 25

C1 Operating prices (before by-products)

4,42

4,76

By-product credits

Cobalt credits

(5,81)

(4,65)

Scan credits

(0,31)

(0,58)

Ammonium sulfate credits

(0,17)

(0,16)

Total credits

(6,28)

(5,39)

Charge C1 total credits per by-product

(1,86)

(0,63)

Note: Credits for by-products over US$59,512/t Co (equivalent metal), US$1,500/kg Sc2O3 and US$130/t amsul.

You can get a photo that accompanies this ad in https://www.globenewswire.com/NewsRoom/AttachmentNg/e4f160b5-64f0-4900-a007-effc6b9dee0a

Program

Work continues to optimize the start-up structure and schedule. The existing estimate remains an engineering, procurement and structure schedule from the signing of an EPCM contract to the first production of approximately 3 years, followed by a 24-month increase to complete production.

FUNDING AND DEVELOPMENT

COVID-19 presented sensitive situations for money markets and demanding situations for the financing of new projects. Fortunately, the commitment to the auto industry at Sunrise continues, despite these demanding situations.

Automotive supply chains will need time to adapt to a new reality. Some OEMs are making this transition faster than others, and some, like Tesla, are beginning to sense the enormity of raw challenges, especially for nickel and cobalt.

At some point, significant investments in new mining capacity will be necessary if electric cars are destined for anything other than a niche market. To date, at least in nickel and cobalt, the mining industry is not in a position to make such an investment.

While it is not imaginable to wait for the final touch of a transaction, Clean TeQ will continue to interact with potential partners throughout the source chain.

As Mr. Riggall noted, “We are fully committed to Sunrise’s progression. We are also ready to be patient and wait for market situations to improve. In recent years, we have been incredibly selected, completing a comprehensive testing and study program, obtaining primary assignment approvals and securing the resource The result is a decades-ready asset to be built, generating some of the cheapest nickel and cobalt sets in the industry, designed for more than one million electric cars per year.

Following the publication of the final effects of the PEP at the end of September, the company will conduct a webcast for investors to review the effects of the SunriseArray.

UPDATE ON FUTURE ON-SITE EXPLORATION ACTIVITIES

In the coming weeks, the Company will inform the market of a paint program to verify Sunrise’s deeper mineral potential. While the Sunrise laterite has more than a million ounces of 5-platinum, a drilling crusade has never been carried out to verify the source of this steel under the laterite.

5 For more information, see the ASX announcement on October 9, 2017.

As Friedland noted, “it’s hard to think of a larger drilling target in Australia than the Sunrise dunita, with more than a million ounces of platinum already placed on the surface and a handful of historic perforations intercepting high-quality platinum on the rock bed.” but never follow up good enough. The Sunrise resource would possibly have much more to offer.”

For more information, contact:

Ben Stockdale, CFO and Investor Relations – 3 9797 6700

This announcement is legal to be on the market through the Board of Directors of Clean TeQ Holdings Limited.

About Clean TeQ Holdings Limited (ASX/TSX: CLQ): Headquartered in Melbourne, Australia, Clean TeQ is a global leader in steel recovery and commercial water remedy by applying its patented Clean-iX continuous ion exchange technology®. To learn more about Clean TeQ, visit the company’s online page www.cleanteq.com.

About the Clean TeQ Sunrise: Clean TeQ assignment is the 100 percent owner of the Clean TeQ Sunrise assignment in New South Wales. Clean TeQ Sunrise is one of the largest outdoor cobalt deposits in Africa and one of the largest and richest scan accumulations ever discovered.

About Clean TeQ Water: Through its wholly owned subsidiary Clean TeQ Water, Clean TeQ also provides state-of-the-art solutions to remedy wastewater to eliminate hardness, desalination, nutrient removal and liquid discharge. Response spaces include municipal wastewater, surface water, commercial wastewater and mining wastewater. For more information about Clean TeQ Water, visit www.cleanteqwater.com.

FUTURE STATEMENTS

Certain statements contained in this press release constitute “forward-looking statements” or “forward-looking statements” within the meaning of applicable securities laws. Such statements involve known and unknown risks, insecurities, and other points that would possibly cause the Company’s actual effects, functionality or effects to differ materially from any effects, functionality, or long-term accomplishments expressed or implied through such forward-looking statements. or information. These statements can be known by using words such as “possibly,” “could,” “could,” “will be,” “pretend,” “expect,” “believe,” “plan,” “anticipate,” “estimate,” “” plan,” anticipate “, ” anticipate “and other terms, or imply that certain actions, occasions or effects ‘could’, ‘could’, ‘could’, ‘could’ or ‘could’ be ‘be’, ‘would’ These statements reflect the Company’s existing expectations related to occasions, functionality and long-term effects , and are valid only as of the date of this new release.

The statements contained in this press release that constitute forward-looking statements or data are, but are not limited to, statements regarding: the final touch of Sunrise’s assignment execution plan; Sunrise allocation financing; the prospects of electric vehicle markets and demand for nickel and cobalt; EPCM and the start-up schedule and capital progression charges of the Sunrise allocation; production volumes and production load and sustainability of Sunrise steel production. Readers are cautioned that the actual effects may differ from those presented. All of this forward-looking data and statements are based on secure assumptions and analyses made through Clean TeQ’s control based on your delight and belief of old trends, existing situations and long-term expected progressions, as well as other points that the control deems appropriate in However, these statements are subject to a variety of dangers and insecurities and other points that may also cause actual occasions or effects to differ materially from those forward-looking data or statements, including but not limited to, unforeseen adjustments to laws, regulations or regulations, or their application through the relevant authorities; The inability of the contracting parties to implement as agreed; Changes in commodity charges unplanned or inadequate infrastructure failures, or delays in infrastructure progression, and failures of exploration systems or other studies to provide the expected effects or effects that would warrant further study, progression, or operations. Other vital points that may also cause actual effects that differ from such forward-looking statements also come with those described in “Risk Factors” in the Company’s most recent Annual Notice, which is under its SEDAR profile in www.sedar.com.

Readers are cautioned to rely unduly on forward-looking data or statements.

While the forward-looking statements contained in this press release are based on what the Company’s control considers moderate assumptions, the Company warrants to investors that the actual effects will be consistent with such forward-looking statements. These forward-looking statements are made as of the date of this press release and are expressly qualified in their entirety through this warning. Subject to applicable securities laws, the Company assumes no legal responsibility to update or revise the forward-looking statements contained herein, to reflect occasions or cases that occur after the date of this press release.