Founded in 1993, The Motley Fool is a corporate money service committed to the smartest, happiest and rich meeting. The month of Motley Fool Res Millions of other people, thanks to our premium investment solutions, loose recommendation and a market research at Fool. com, non -public monetary education, podcasts with more productive qualification and a Motley Fool base base.

Founded in 1993, The Motley Fool is a corporate money service committed to the smartest, happiest and rich meeting. The month of Motley Fool Res Millions of other people, thanks to our premium investment solutions, loose recommendation and a market research at Fool. com, non -public monetary education, podcasts with more productive qualification and a Motley Fool base base.

The actions of Tesla (TSLA -3. 01%) first higher, the shoulders of a report under profits before the name was taken in the sale of the War of the Industry. The electric car manufacturer (EV) had a complicated year in 2024, executive leader Elon Musk is still very positive in the long term. This includes the most recent call of the company for the company, when he said that Tesla movements can be more valuable in the long term than the next five combined global companies.

Let’s look more closely at the maximum recent effects of Tesla to see if the action deserves to be bought.

For the fourth quarter, the revenues of Tesla greater than 2% of one year to the next 25. 7 billion dollars. The benefit adjusted to the benefit (BPA), on the other hand, higher at $ 3% at $ 0. 73, while the benefits adjusted before interest, taxes, depreciation and amortization (EBITDA) higher up to 25% to 4. 9 billion dollars. The benefit measures were injured through a leap of 9% of the operating expenses and a fundamental point of 138 gross margin problems from 17. 6% to 16. 3%.

The effects of Tesla have lost the expectations of analysts in the lines and decreases. Analysts sought BPA of $ 0. 76 and a turnover of $ 27. 3 billion, compiled through LSE.

The automotive revenue source has flumed from 8% to 19. 8 billion dollars, while 3 / and built users to 2% to 422,405 vehicles. Other styles, adding their cybertruck, have noticed that deliveries accumulate at 3% to 23,640 vehicles.

The general production of cars in the quarter, on the other hand, fell by 7%to 459,445. The production of style 3 / and decreased to 8%, while other producers higher than 25%.

Weak figures occur despite Tesla, providing a series of promotions in the quarter. In North America, he presented discounts for consumers referred through other Tesla consumers, while in China, he dropped the value of his style SUV before the launch of his juniper model Y.

On the positive side, the company said it continued in charge of production in its vehicles. He said in the fourth quarter that prices have reached the lowest point of all time, less than $ 35,000 consisting of the vehicle.

Fueros cars, the other corporations in the company have been carried out well. Its billing of energy production and garage have more than duplicated by approximately $ 3. 1 billion, while the service and another source of income increased from 31% to 2. 8 billion dollars. Megapack and Powerwall had record implementations of 11. 0 GWh combined the quarter, which led to a gross benefit record for the segment. The source of service income, on the other hand, was helped because the corporate added 3,000 new positions to its excess food network.

For the future, Tesla has provided any official prognosis by 2025. However, Musk said he hopes that the vehicle activity will return to expansion in 2025. He added that Tesla will release without supervision as a service paid in Austin, Texas, in June and in June. He hopes driving without attenuations with his internal fleet in several cities until the end of the year. In addition, Musk said vehicle brands were interested in granting licenses to their technology.

Musk also continues to announce the humanoid robot Humanoid Optimus in Tesla, saying that the plan is to build 10,000 Optimus robots through the end of the year and add that they will do “useful things. “

According to its promotional nature, Musk said there a path through which Tesla may be more valuable than the most productive corporations in the combined capitalization of the market. Tesla the largest corporate seventh in the S&P 500 at the end of the year. This result is very unlikely, in my opinion.

At this point, Tesla strives to get away from its EV activities of investors, basically due to its mediocre performance. The company has been represented for a long time as a technological company, not as a car manufacturer, however, the figures say it is precisely what it is: an automotive company.

Tesla had 16. 3% of the raw margins and 6. 2% of the operating margins in the fourth quarter, which is very a car company only for a technological business. In comparison, General Motors (GM -1. 73%) had a gross automatic margin of 12% and an operational margin of 6. 8% in 2024. A technological curtain company, such as NVIDIA, has a gross margin of approximately 75% and 62% of Operational margin.

Musk continues to make primary promises, and even when Tesla’s winning calls laughed at the fact that he is necessarily the child who called Wolf. However, he said there was actually a wolf this time with his autonomous car. However, even if the company is approaching autonomous driving, it is still Waymo D’Arphat, which already operates in a safe number of US cities, and the economic style is not yet proven.

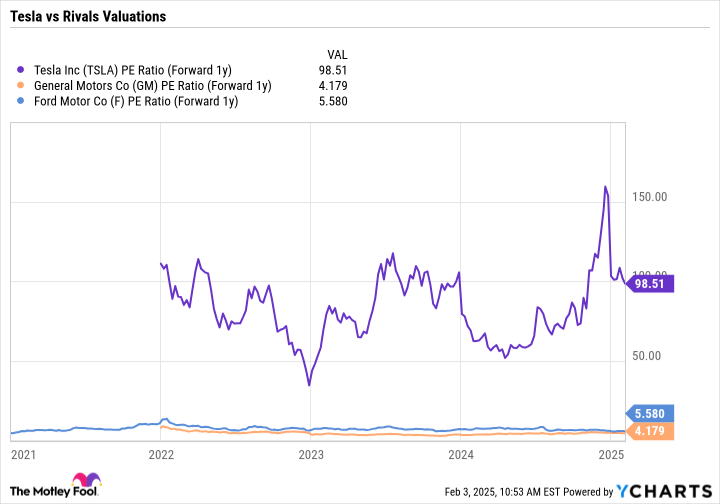

From the point of view of the evaluation, Tesla is negotiated with a ratio of valuable advantages / get (p / e) in the end 98. 5 times founded on the estimates of the analysts of 2025. This is compared to a P / E before 5. 6 times for Ford (F) and 4. 2 times for GM.

At this point, Tesla is not negotiated according to the basic principles of its activities still about what was beaten and hope. This is not my type of investment, however, it has been a successful strategy for the company for a long time, and there is no indications that it will end soon. While investors buy Musk’s vision, the inventory can continue to negotiate.

Suzanne Frey, director of Alphabet, is a member of the Motley Fool’s Board. Geoffrey Seiler has alphabet positions. Motley Fool has positions and recommends Alphabet, Nvidia and Tesla. The Motley Fool recommends General Motors. The Motley Fool has a dissemination policy.

Mercado knowledge promoted through Xignite and Polygon. io.